Investing in the stock market has become quite common nowadays. Many investors put their money directly into shares or through mutual funds. But the main challenge for most investors is how to analyse the huge amount of data and financial reports before making any investment decision. This is where a Research Analyst plays a major role.

A Research Analyst studies and analyses stocks, mutual funds, derivatives, and other financial instruments to help investors take the right decision. Based on their research, they provide recommendations like whether to buy, sell, or hold a particular security. These suggestions can help investors reduce risk and earn better returns. However, it is important that the research and advice provided by these analysts is unbiased and free from any conflict of interest.

To bring transparency and ensure independence in research-related activities, SEBI (Securities and Exchange Board of India) introduced the SEBI (Research Analyst) Regulations, 2014. This regulation controls the activities of those individuals or companies whose main business involves publishing or issuing research reports on listed securities. If you want to become a Research Analyst or are planning to start a research firm, it is important to understand the process of SEBI Research Analyst Registration.

New guidelines for the enlistment of entities as Research Analysts (RAs) and Investment Advisers (IAs)

On July 24, 2024, the Bombay Stock Exchange (BSE) announced new guidelines for the enlistment of entities as Research Analysts (RAs) and Investment Advisers (IAs). All currently registered Research Analysts and Investment Advisers, as well as new applicants seeking registration, must retain their SEBI Registration Certificates and adhere to the byelaws, guidelines, regulations, directives, and circulars issued by SEBI and the Exchange on an ongoing basis.

Additionally, all existing SEBI-registered Research Analysts and Investment Advisers who hold memberships with BASL will automatically be enlisted on the Exchange starting July 25, 2024. From that date, individuals applying for registration as Research Analysts can submit their applications through the Bombay Stock Exchange's online portal.

SEBI Research Analyst Registration is an important step for anyone planning to offer research and advisory services in the Indian securities market. Whether you are an individual or a company, the registration helps establish your credibility and ensures that your research meets the regulatory standards set by SEBI. It is important to understand the regulations, check your eligibility, and follow the process carefully to avoid delays or rejection.

If you need help with your Research Analyst Registration, Compliance Calendar provide complete assistance from checking eligibility to getting your Research Analyst Registration certificate from SEBI. Reach out to us today for consultation through mail info@ccoffice.in or Call/Whatsapp at +91 9988424211.

Who is a Research Analyst?

A Research Analyst is a professional or an organization that studies and analyses financial data to provide investment advice. This advice is usually in the form of recommendations like whether to buy, sell, or hold a particular security such as a stock, mutual fund, bond, or derivative. The main role of a Research Analyst is to evaluate the performance, risks, future prospects, and financial health of a company or financial instrument. Based on this detailed study, the analyst provides price targets, market views, and predictions to help investors make informed investment decisions.

A Research Analyst may be an individual working independently or may be employed by a company,LLP, or financial institution. Interestingly, even if someone is not officially called a “Research Analyst,” but is doing similar work such as preparing reports, issuing investment opinions, or assisting in the preparation of research data, they will still be considered a Research Analyst under SEBI’s definition. This includes people who collect financial data, perform sectoral analysis, or support the analyst in making investment-related recommendations. The SEBI (Research Analyst) Regulations, 2014, apply to all such individuals or entities involved in this kind of research activity on listed securities or those proposed to be listed.

What is a Research Report?

A Research Report is a document, either in written or electronic format, that presents detailed analysis, findings, and opinions about a financial instrument or security. The purpose of this report is to guide investors by offering insights that can influence their investment decisions. A typical research report includes company analysis, industry outlook, financial data, future projections, valuation models, and investment recommendations. For example, the report may recommend buying a stock based on its current undervaluation or suggest holding an investment based on future growth potential.

Research reports are not limited to company stocks. They can also include mutual funds, debentures, public offers, IPOs, and derivatives. Such reports often include a recommendation like “buy,” “sell,” or “hold,” and may also include a price target or rating for the security. SEBI considers any such communication, whether it's distributed through emails, newsletters, online platforms, or financial blogs, as a research report if it includes recommendations or opinions based on financial analysis. Therefore, individuals or entities regularly issuing such research reports fall under the scope of SEBI Research Analyst Regulations, even if they are doing so through informal platforms like personal blogs or social media pages.

Benefits of SEBI Registered Research Analyst in India

The following are the benefits of Research Analyst Registration in India:

Studying & Problem-Solving Skills

A SEBI Registered Research Analyst possesses deep knowledge and knowing the financial and capital markets. With this expertise, they are trained to identify, analyze, and solve complex financial issues. Their problem-solving abilities allow them to understand market behavior, assess investment risks, and interpret financial data. This helps clients navigate challenges like market volatility, regulatory changes, and economic downturns more confidently and accurately.

Quality Research

Research conducted by SEBI-registered analysts follows a strict regulatory framework and ethical standards. This ensures that their research reports are fact-based, data-driven, and unbiased. The quality of research is enhanced through proper disclosure of risks, clear methodologies, and adherence to compliance guidelines. Investors benefit from reliable insights and can make informed decisions, thanks to the trust and credibility attached to SEBI-authorized research.

Access to Information

SEBI Registered Research Analysts are allowed to access certain industry or company-specific information that might not be easily available to the general public. This access includes detailed financial statements, management interviews, and corporate announcements, which enable analysts to form a clearer picture of a company’s potential. With such privileged information, they can guide investors with sharper and more strategic investment decisions.

Help in Managing Investment Portfolio

A SEBI registered Research Analyst not only studies the market but also supports investors in organizing and balancing their investment portfolios. Through thorough analysis of stock performance, risk assessment, and future projections, they help optimize investment returns while minimizing risks. Their recommendations can guide clients on when to enter or exit a stock, switch between sectors, or rebalance the portfolio based on financial goals and market conditions.

Applicability of SEBI Research Analyst Regulations

One of the most common questions among finance professionals, bloggers, investment advisors, and market enthusiasts is whether they need to register as a Research Analyst under SEBI’s regulatory framework. The answer depends on the nature and extent of the activities being carried out. If you are engaged in preparing, publishing, or providing investment recommendations on listed securities such as shares, mutual funds, bonds, debentures, or derivatives, then the SEBI Research Analyst Regulations are applicable to you. This includes providing views on initial public offerings (IPOs), new fund offers (NFOs), or giving price targets based on your own research and analysis. Even if you are working as a broker, investment banker, or merchant banker and are involved in preparing or circulating research reports or analysis, you will fall under the scope of these regulations. Furthermore, anyone who directly or indirectly supports a Research Analyst by assisting in the creation or review of reports may also come under the definition, depending on the level of involvement.

However, SEBI has also clearly laid down certain exemptions. If your activities are limited to offering general views on market trends or specific industries, or if you are simply presenting publicly available financial data in an understandable format without giving investment advice, you are not required to register. Similarly, providing technical analysis that focuses only on sector demand-supply movements or analysis of spot commodities or broad-based indices does not qualify as research under the SEBI framework. Individuals involved only in formatting or publishing reports, without adding their own analysis or opinion, are also exempt. Additionally, companies such as mutual fund houses, alternative investment funds, and registered investment advisers are not required to obtain a separate SEBI Research Analyst Registration. However, they are still expected to comply with the ethical and operational norms mentioned in Chapter III of the SEBI (Research Analyst) Regulations, 2014.

If you are giving investment-related recommendations or involved in preparing research reports for public or client consumption, then SEBI Research Analyst Registration becomes mandatory. If you are unsure, it is advisable to carefully assess your role and consult with Compliance Calendar expert to determine whether your activities fall under the scope of SEBI’s regulatory framework.

Eligibility Criteria for Research Analyst Registration under SEBI

To become a SEBI Registered Research Analyst, it is essential to meet the eligibility conditions laid down under the SEBI (Research Analyst) Regulations, 2014. These regulations ensure that only qualified, competent, and financially sound individuals or entities are permitted to offer research analysis services to investors. This helps maintain the integrity, reliability, and professionalism in the securities market. The eligibility requirements broadly fall under two main categories – Qualification & Certification Requirements and Capital Adequacy Requirements. Let’s understand both in detail.

Qualification & Certification Requirements

The first and most important criterion for SEBI Research Analyst Registration is academic and professional qualification. SEBI mandates that any individual or employee/partner of an entity intending to register as a Research Analyst must possess relevant educational credentials in finance or related fields. A person must have a postgraduate degree or diploma in disciplines such as Business Management, Finance, Economics, Commerce, Capital Markets, or Financial Services. This qualification should be obtained from a university or institute recognized by the Central or State Government, or from an internationally recognized institution or association.

Alternatively, the qualification can be one that is accredited by national bodies such as the All India Council for Technical Education (AICTE), National Assessment and Accreditation Council (NAAC), or the National Board of Accreditation (NBA). These are Indian statutory bodies responsible for maintaining academic standards in technical and higher education. Additionally, institutions or councils set up under an Act of Parliament in India are also acceptable for academic recognition.

For those who do not hold a formal postgraduate degree or diploma, SEBI also allows registration if the applicant is a graduate in any discipline but possesses a minimum of five years of relevant work experience in the field of financial products, securities, asset management, fund management, or portfolio advisory services. This experience must be well documented and verifiable through experience certificates issued by the previous employer(s).

Apart from the academic qualification, the applicant is also required to possess a valid NISM Research Analyst Certification. This certification is a mandatory requirement and is governed by SEBI. The relevant examination is called NISM Series XV: Research Analyst Certification Examination, which tests the candidate’s knowledge in equity research, fundamentals, valuation models, ethics, regulatory framework, and other related topics. SEBI may also notify other recognized certifications from time to time in place of or in addition to the NISM certification.

Certain professional qualifications are also considered valid under this criterion. These include degrees such as Chartered Accountant (CA), Company Secretary (CS), Cost Accountant, MBA in Finance, M.Com, Chartered Financial Analyst (CFA), Postgraduate in Banking and Finance, and Master’s in Economics. If an applicant holds any of these degrees and also clears the required NISM certification, they fulfill the educational and certification eligibility under SEBI’s norms.

In the case of non-individuals such as companies or LLPs, it is important to note that the eligibility criteria must be met by the partners or employees who will actually be carrying out the research and analysis. If a director or partner is only involved in the company’s management and not in research-related tasks, then they are not required to meet the qualification criteria.

Capital Adequacy Requirement

The second important criterion for SEBI Research Analyst Registration is related to the financial standing of the applicant, known as capital adequacy. SEBI requires that an applicant should be financially sound to ensure the long-term sustainability and credibility of research services.

For individuals, including proprietorship firms and partnership firms, the net tangible assets should be not less than ?1 lakh. Net tangible assets refer to all tangible assets owned by the applicant such as laptops, residential property, bank balances, fixed deposits, vehicles, stocks, mutual funds, and other financial investments. From this, liabilities such as home loans, car loans, education loans, and other debts must be deducted to arrive at the net figure. A net worth certificate must be obtained from a Chartered Accountant, and it should include the CA’s signature, membership number, and seal.

For LLPs and companies, the minimum net worth requirement is ?25 lakhs. Net worth in this case is calculated as the aggregate value of paid-up share capital and free reserves (excluding revaluation reserves) minus the accumulated losses. If the company (Private Limited Company, Public Limited Company, etc.) or LLP does not currently meet this requirement, it can raise capital by issuing more shares (in the case of companies) or by increasing the capital contribution (in the case of Limited Liability Partnerships). A certified net worth statement by a Chartered Accountant is also required to prove compliance.

Meeting these eligibility criteria is the first step toward becoming a SEBI Registered Research Analyst. It ensures that only qualified and financially stable individuals or entities can carry out research activities that influence public investment decisions in India’s financial markets.

NISM Certificate for Research Analyst (NISM-Series-XV)

Becoming a SEBI-registered Research Analyst is an important step for anyone looking to build a strong and credible career in the Indian financial markets. One of the most important requirements to achieve this is obtaining the NISM Certificate for Research Analyst (NISM-Series-XV). This certification, issued by the National Institute of Securities Markets (NISM), is not only a regulatory requirement under the SEBI (Research Analyst) Regulations, 2014 but also a valuable qualification that enhances your knowledge, boosts professional credibility, and signals your commitment to ethical and responsible research practices.

The NISM Certificate for Research Analyst is designed for individuals aspiring to work in the areas of equity research, financial analysis, and investment advisory. This certification program equips candidates with the right set of technical and analytical skills needed to operate effectively in India’s capital market. By clearing this examination, individuals demonstrate their understanding of securities analysis, regulatory frameworks, valuation techniques, and the standards of professional conduct expected of Research Analysts. In today’s competitive environment, having this certification not only fulfills a legal requirement for SEBI Research Analyst Registration but also strengthens your profile in the eyes of employers and clients.

NISM, established in 2006 as an educational arm of SEBI, has been actively promoting financial education, awareness, and skill development in the securities market. Through its wide range of certification programs, NISM ensures that professionals in the capital markets are up-to-date with regulatory guidelines, operational practices, and ethical conduct. The NISM-Series-XV: Research Analyst Certification Examination is one of the most sought-after programs, especially among those who want to register with SEBI as a Research Analyst and begin a career in market research and investment advisory services.

This certification is suitable for a wide range of individuals, including finance professionals, students, and corporate employees. There are no specific educational or age-related requirements to take the exam, making it accessible to beginners as well as experienced market participants. Investment advisers, mutual fund distributors, equity analysts, portfolio managers, and even fresh graduates from commerce and finance backgrounds can all benefit from this certification. Students and entry-level professionals use it to improve their CV and demonstrate domain knowledge, while working professionals use it to upskill and meet SEBI’s mandatory requirements.

In addition to the NISM-Series-XV certification, NISM offers several other popular programs such as Currency Derivatives (Series I), Mutual Fund Distributors (Series V-A), and Securities Operations and Risk Management (Series VII). However, for those looking to become SEBI-registered Research Analysts, Series XV is the relevant and compulsory certification. This exam tests candidates on their knowledge of equity markets, financial ratios, valuation methods, industry analysis, macroeconomic indicators, and SEBI’s code of conduct for Research Analysts.

The registration process for the NISM certification is simple and completely online. Candidates need to visit the official website of NISM (www.nism.ac.in) and create an account using their personal and identification details. Once registered, they can choose the relevant exam (such as Series XV), make the online payment (generally between ?1500 to ?3000), and schedule the exam at any of the authorized centers across more than 150 cities in India. The exam is computer-based and typically consists of multiple-choice questions. After clearing the exam, candidates receive a certificate that remains valid for three years.

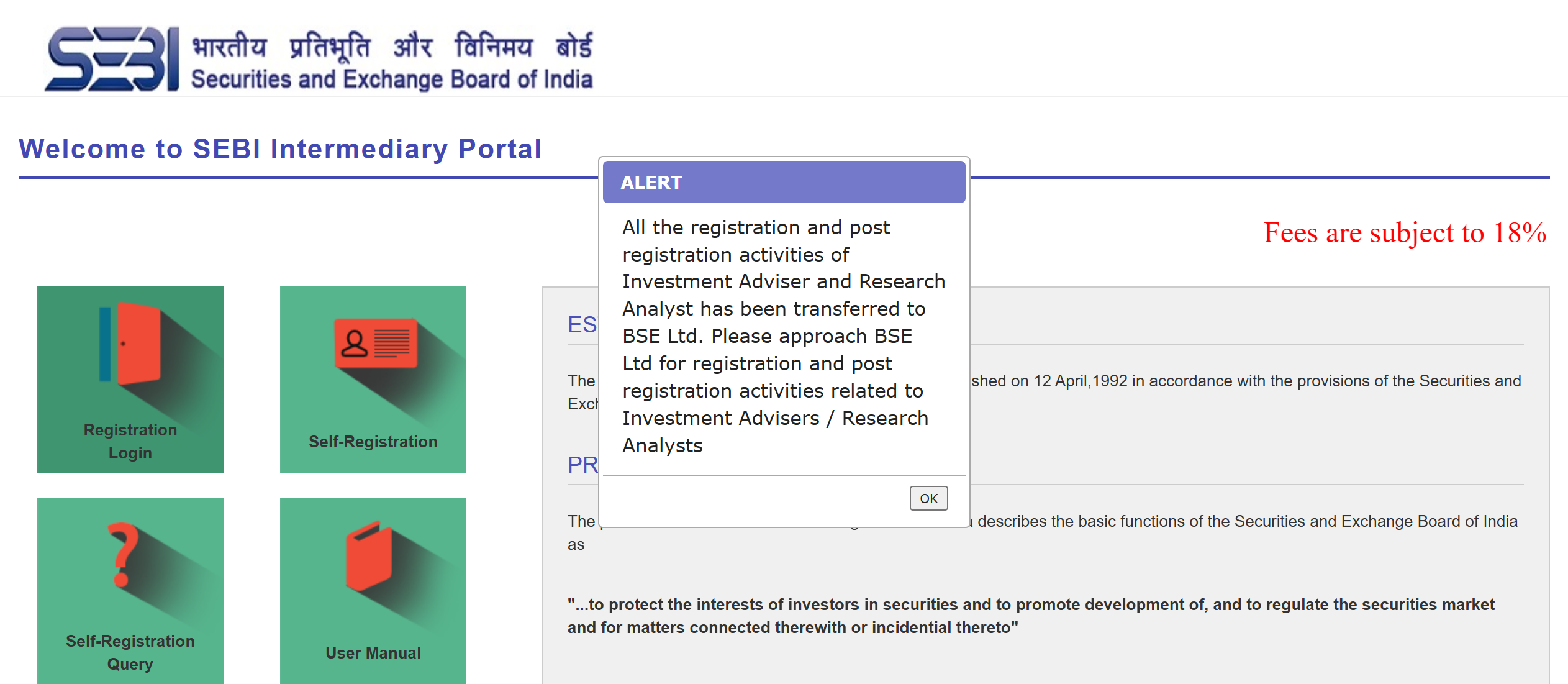

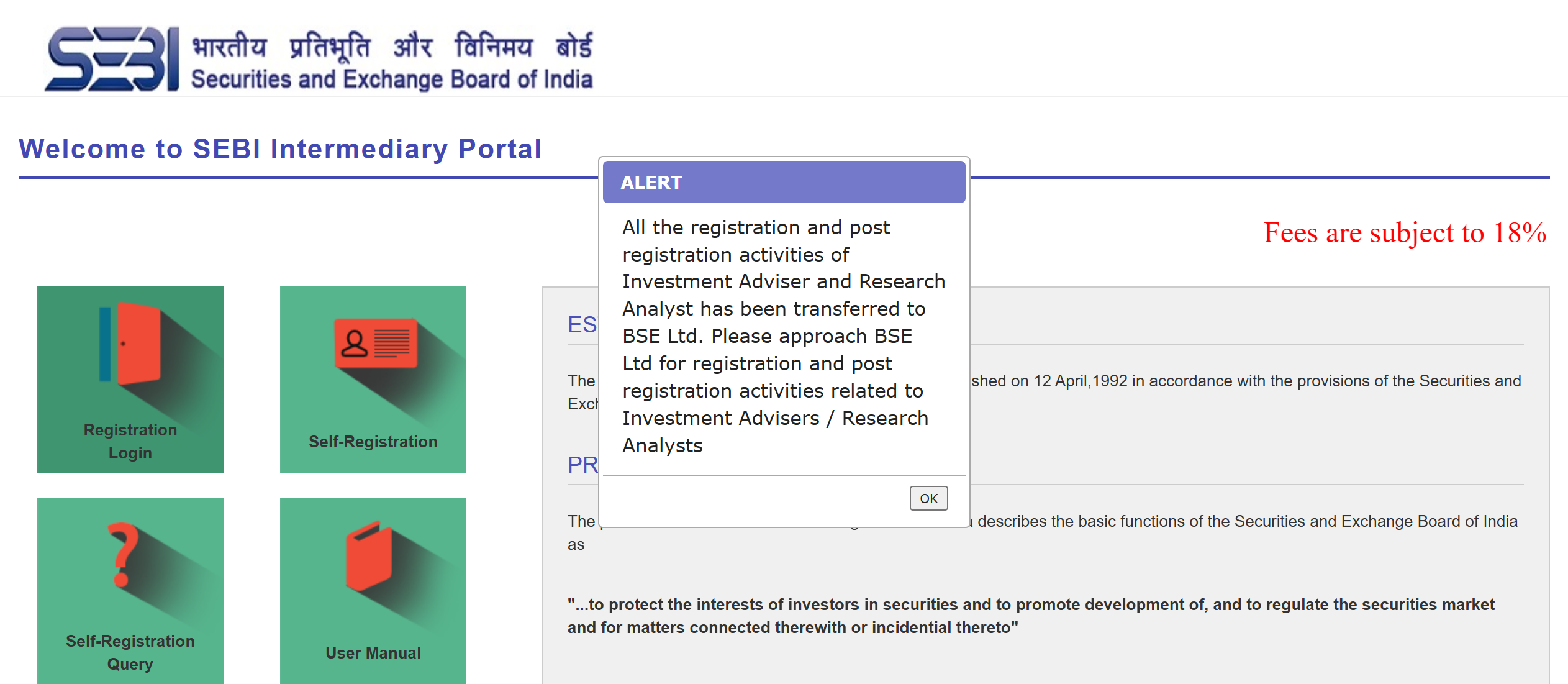

Clearing the NISM Research Analyst exam is the first step. Once the certification is obtained, individuals can proceed to apply for SEBI Research Analyst Registration via the BSE Intermediary Portal. For those who need support throughout this journey—from exam registration to documentation and SEBI approval—professional help can make the process smooth and error-free.

At Compliance Calendar LLP, we help you at every stage of this journey. Whether you are a student preparing for the NISM exam, a professional applying for SEBI registration, or a company planning to onboard Research Analysts, our team offers complete assistance. From helping you understand eligibility criteria to preparing the documents for registration, we ensure that your SEBI Research Analyst Registration process is successful and efficient.

The NISM Certificate for Research Analyst is not just an exam but an essential tool for career advancement in India’s fast-growing financial services sector. If you're serious about becoming a SEBI-approved Research Analyst, now is the perfect time to get certified and move closer to your professional goals. Get in touch with us today to begin your journey!

SEBI’s Standardized Periodic Reporting for Research Analysts and Proxy Advisors

Periodic reporting has become an essential part of regulatory compliance for Research Analysts (RAs) and Proxy Advisors (PAs) under the Securities and Exchange Board of India (SEBI). In its latest move to strengthen transparency and accountability, SEBI has introduced a structured reporting format that must be followed by these market participants. This initiative not only brings uniformity in reporting but also allows SEBI to monitor and regulate the functioning of research analysts and proxy advisors more efficiently. Through this article, we aim to help you understand the complete process of periodic reporting, its purpose, reporting deadlines, format, and compliance-related challenges.

Periodic reporting means submitting detailed information and data by RAs and PAs at regular intervals to the regulatory authorities. As per SEBI’s latest guidelines, all research analysts are required to submit half-yearly reports to the Research Analyst Administration and Supervisory Body (RAASB), which is managed by BSE Ltd. Proxy advisors, on the other hand, will have to submit their periodic reports directly to SEBI. This reporting requirement ensures that research professionals maintain transparency in their operations, provide accurate disclosures about their business practices, and follow the code of conduct as prescribed by SEBI.

The reporting must be done twice every year. The first reporting period will end on March 31, 2025, and the due date for submission is April 30, 2025. From then onwards, the cycle will continue with reports due by October 30 for the period ending on September 30, and April 30 for the period ending on March 31 each year. This six-month gap between reporting deadlines gives enough time to RAs and PAs to prepare and compile the necessary data for submission. It is mandatory for both individual and non-individual research analysts to follow this schedule.

SEBI has provided a standardized format for reporting, which is specified in Annexure I of its circular. Research analysts must log in to the BSE RAASB portal to download this format. The reporting form includes several fields such as registration details, website and social media handles, advertisements issued, bank accounts used for fee collections, shareholding pattern, list of directors or partners, complaints received, and details of non-resident clients. It is crucial to ensure that this information is accurate, up to date, and compliant with SEBI guidelines.

All reports for research analysts must be submitted through the RAASB BSE portal, whereas proxy advisors need to send their reports directly to SEBI. BSE may also issue more specific instructions or updates from time to time, so it is advisable to regularly check for new circulars and guidance notes.

A key addition in this reporting structure is the inclusion of non-resident client details. Research analysts must report these details in their periodic submissions as per Table-3 of Annexure I. However, there is a relaxation—if the research service is provided free of cost as an additional benefit to clients who have subscribed to stockbroking, PMS, or other services, then such client details are not required to be submitted. This ensures that only those who offer paid, standalone research services are brought under deeper scrutiny.

In a related development, SEBI has also allowed non-individual Investment Advisers to obtain an annual compliance certificate from any registered auditor for client-level segregation. This provides more flexibility and reduces the compliance burden while ensuring that client interests are protected. Investment Advisers also need to submit their half-yearly reports within 30 days from the end of each reporting period, similar to research analysts.

Periodic reporting plays a crucial role in bringing transparency, accountability, and trust to the financial ecosystem. It ensures that SEBI can track the conduct, complaints, and business activities of research analysts and proxy advisors in a structured manner. Timely and accurate reporting enhances investor confidence and promotes better regulation of the securities market.

To avoid non-compliance penalties, research analysts should start early by downloading the reporting format, collecting all the required information, especially non-resident client details, and verifying the accuracy of the report before submission. Staying updated with any new changes from SEBI or BSE and being organized throughout the reporting process is essential for a hassle-free experience.

If you need assistance with your SEBI periodic reporting, you can reach out to Compliance Calendar LLP via email at info@ccoffice.in or call/WhatsApp at +91 9988424211. Our expert team is ready to guide you through every step to ensure timely and compliant submission.

Documents Required for Research Analyst Registration

For Body Corporate/Company:

- 15-digit GST number or relevant declaration.

- PAN card of the body corporate/company.

- If owned: Sales Deed or Recent Utility Bill.

- If rented: Registered Rent Agreement or Bank Statement/Passbook.

- Additional Requirements for Residential Address:

- NOC from the owner.

- Ownership Proof (Sales Deed/Recent Utility Bill).

- Address proof should be in the name of the Body Corporate/Company.

- Compliance Officer Documents: Self-attested PAN and Aadhaar.

- Company Incorporation Documents:

- Certificate of Incorporation (COI).

- First page of MOA.

- Registration with Stock Exchange:

- If registered: Provide relevant details.

- If not: Declaration on the company's letterhead signed by an authorized signatory.

- On the company’s letterhead.

- Personal Details of Authorized Persons:

- PAN copy as identity proof.

- Aadhaar Card or Passport as address proof.

- Qualification proof (course completion certificates as per SEBI RA Regulations, 2014).

- Experience proof (certificates on employer's letterhead as per SEBI RA Regulations, 2014).

- Certification proof (valid certificate as per SEBI RA Regulations, 2014).

- Masked Aadhaar or Aadhaar consent letter if Aadhaar is used.

- Financial and Business Details:

- Assets and liabilities statement certified by a Chartered Accountant (not older than 6 months).

- Copy of ITR/Form 16 for the last 3 years.

- Business plan detailing proposed research analyst services.

- Internal Policies and Disclosures:

- Documents addressing conflict of interest.

- Standard disclosures document.

- Infrastructure Details: Office space, equipment, furniture, communication facilities, research capacity, and software.

- Disputes:

- Details of all settled/pending disputes in the last 5 years.

- Declaration if no disputes exist.

For Individual/Sole Proprietor:

- Proprietor Name Format: Must include “Individual Name (Proprietor: Name of the Proprietorship Firm).”

- Basic Information:

- If owned: Sales Deed or Recent Utility Bill.

- If rented:

- Registered Rent Agreement or Aadhaar with Consent Letter/Passport/Bank Statement/Passbook.

- NOC from the owner (for residential address).

- Ownership Proof (Sales Deed/Recent Utility Bill).

- PAN copy as identity proof.

- Aadhaar Card or Passport as address proof.

- Qualification proof (course completion certificates as per SEBI RA Regulations, 2014).

- Experience proof (certificates on employer's letterhead as per SEBI RA Regulations, 2014).

- Certification proof (valid certificate as per SEBI RA Regulations, 2014).

- Masked Aadhaar or Aadhaar consent letter if Aadhaar is used.

- Financial and Business Details:

- Assets and liabilities statement certified by a Chartered Accountant (not older than 6 months).

- Copy of ITR/Form 16 for the last 3 years.

- Details of proposed research services.

- Other relevant information about research services.

- Internal Policies and Disclosures:

- Conflict of interest policies and procedures.

- Declaration regarding infrastructure availability.

- Infrastructure Details: Office space, equipment, furniture, communication facilities, research capacity, and software.

- Disputes:

- Details of all settled/pending disputes in the last 5 years.

- Declaration if no disputes exist.

For Partnership Firms/LLPs:

- Registered Partnership Deed (for partnership firms).

- LLP Agreement (for LLPs).

- 15-digit GST number or relevant declaration.

- PAN card of the partnership firm/LLP.

- If owned: Sales Deed or Recent Utility Bill.

- If rented:

- Registered Rent Agreement or Bank Statement/Passbook.

- NOC from the owner (for residential address).

- Ownership Proof (Sales Deed/Recent Utility Bill).

- Compliance Officer Documents: Self-attested PAN and Aadhaar.

- Registration with Stock Exchange:

- If registered: Provide relevant details.

- If not: Declaration on the firm/LLP’s letterhead signed by an authorized signatory.

- Ownership Details: Beneficial ownership pattern.

- Personal Details of Partners:

- PAN copy as identity proof.

- Aadhaar Card or Passport as address proof.

- Qualification proof (course completion certificates as per SEBI RA Regulations, 2014).

- Experience proof (certificates on employer's letterhead as per SEBI RA Regulations, 2014).

- Certification proof (valid certificate as per SEBI RA Regulations, 2014).

- Masked Aadhaar or Aadhaar consent letter if Aadhaar is used.

- Financial and Business Details:

- Assets and liabilities statement certified by a Chartered Accountant (not older than 6 months).

- Copy of ITR/Form 16 for the last 3 years.

- Business plan detailing proposed research analyst services.

- Internal Policies and Disclosures:

- Documents addressing conflict of interest.

- Standard disclosures document.

- Infrastructure Details: Office space, equipment, furniture, communication facilities, research capacity, and software.

- Disputes:

- Details of all settled/pending disputes in the last 5 years.

- Declaration if no disputes exist.

Process of Research Analyst Registration with SEBI

Registering as a Research Analyst with SEBI is a structured process designed to ensure that only qualified and compliant individuals or entities can offer research and advisory services in the Indian securities market. The registration involves multiple steps, each of which plays a crucial role in ensuring transparency and regulatory compliance. Below is a detailed breakdown of the entire process:

1. Payment of Application Fee:

The first step in the Research Analyst Registration process is the payment of the application fee. This fee can be paid via NEFT, RTGS, or Demand Draft. If you choose to pay via Demand Draft, it should be drawn in favour of “The Securities and Exchange Board of India” and made payable at Mumbai. This fee is non-refundable, and proof of payment will be needed during the online application process. It is crucial to retain all transaction details for further reference.

2. Online Application:

Once the payment is done, the applicant—whether an individual or a firm—needs to visit SEBI’s intermediary portal and complete the registration process. The applicant must correctly enter details such as name, PAN, contact number, email address, category (individual or entity), and other relevant information. It is important to ensure that all the information entered matches the official documents that will be submitted later.

3. Filling Payment Details:

After registering, the applicant must log into the portal and enter the payment transaction details. This includes the amount paid, date of payment, payment mode (NEFT/RTGS/DD), bank account number, and transaction reference number. Double-checking the accuracy of these details is essential, as incorrect information may delay or invalidate the application.

4. Receive Request ID:

Upon successful submission of the application and payment details, SEBI sends an acknowledgment email containing a Request ID. This ID serves as a unique reference number that can be used to track the status of your application on SEBI’s intermediary portal. Applicants should save this ID securely for all future correspondence.

5. Login Activation:

After payment verification, SEBI sends another email with an activation link and login credentials. The applicant must use this link to set a secure password and activate their account. Note that the activation link is only valid for 14 days, so timely action is required. Once activated, the applicant gains full access to the dashboard for further documentation and submission.

6. Submit Application Form (Form A):

Now the applicant needs to log in to the SEBI portal and complete Form A, which is the official application form for Research Analyst Registration. Along with this form, various supporting documents must be uploaded. These include identity proof, PAN card, proof of qualification, experience certificate (if applicable), NISM Research Analyst Certification, and net worth certificate issued by a Chartered Accountant. After submitting the form online, the applicant must download the completed Form A, sign it, and send a physical copy to SEBI’s head office or designated regional office by post.

7. Await SEBI’s Response:

Once the complete application is submitted, SEBI reviews the documents. Typically, SEBI will respond within 30 working days. During this period, they may request additional information, documents, or clarifications if any discrepancies or missing details are found. Applicants should respond promptly to avoid unnecessary delays. If all requirements are met, SEBI will proceed to approve the application.

8. Pay Registration Fees:

Following SEBI’s approval, the applicant must pay the registration fees, which is separate from the initial application fee. The mode of payment remains the same—NEFT, RTGS, or Demand Draft. The payment confirmation is a prerequisite before SEBI can issue the registration certificate.

9. Receive Registration Certificate:

After confirming receipt of the registration fee, SEBI issues the Research Analyst Registration Certificate. This certificate is sent to the registered office address mentioned during the application. The certificate officially allows the applicant to commence operations as a SEBI-registered Research Analyst.

The entire registration process may take up to two months, depending on how efficiently the application is submitted and processed. Applicants must ensure that all documents are in order, payment details are correct, and responses to SEBI are timely to ensure smooth and quick registration.

If you require expert assistance in completing the Research Analyst Registration process, professional services like Compliance Calendar LLP can guide you through documentation, filing, and follow-ups with SEBI to ensure hassle-free registration.

Common Reasons for Delay or Rejection in SEBI Research Analyst Registration

Applying for SEBI Research Analyst Registration involves a well-structured process, but despite following all the steps, many applications are either delayed or rejected by SEBI. It is important for applicants to be aware of the common pitfalls that lead to such outcomes. Understanding these reasons in detail can help avoid unnecessary back-and-forth and ensure smooth approval of your application.

One of the most frequent reasons for delay or rejection is the submission of incomplete or incorrect documents. SEBI requires several supporting documents such as proof of identity, educational qualification, NISM certification, net worth certificate from a Chartered Accountant, and details of business activity. If even one of these documents is missing, outdated, or inconsistent with the application form, SEBI may either raise queries or keep the application on hold until proper documentation is provided. For example, if your net worth certificate does not match the prescribed format or is unsigned, your application will not be processed further until the correction is made.

Another common issue is not meeting the educational qualification or certification criteria. According to SEBI guidelines, applicants must either hold a postgraduate degree in finance or a related field, or have five years of relevant work experience along with NISM Research Analyst Certification (Series XV). Many applicants mistakenly believe that personal investing experience or writing blogs on finance qualifies them for registration, which is not always the case. SEBI has stringent requirements, and failure to meet these criteria will result in rejection.

Vague or unclear descriptions of business activity in the application also create problems. SEBI expects applicants to clearly outline the nature of their research work, target clients, mode of operations, and type of recommendations they intend to issue. If this section is left blank or lacks clarity, SEBI may assume the applicant is unaware of the responsibilities and scope of a registered Research Analyst, leading to rejection or further inquiries.

Another reason for rejection is submitting an application when SEBI Research Analyst Regulations don’t even apply to the applicant. Many individuals apply simply to be "on the safe side," even when they only provide general market commentary or educational content that does not qualify as regulated research. SEBI may reject such applications stating non-applicability of the regulation.

Finally, SEBI has the discretionary authority to hold or reject an application if there is any ambiguity, inconsistency, or lack of confidence in the applicant’s intent or qualifications. Officers at SEBI may interpret rules differently based on the information submitted. Therefore, it is always advisable to review every detail, confirm eligibility, and seek expert help if required before applying. Proper preparation and full disclosure are the keys to avoiding delays and securing timely registration.

Compliance Calendar ®

Compliance Calendar ®