Overview

Non-Governmental Organizations work for social and charitable purposes resulting in benefit of societies and social welfare. There are various privileges available to NGO’s after obtaining certain registrations, the same are listed below:

There are varied exemptions and privileges available to NGO’s with respect to Tax Exemptions, In order to claim these exemptions, an NGO must register themselves under Section 12A and 80G of Income Tax Act, 1961

12A: NGO acquiring such a certificate is exempted to pay income tax on its surplus income.

80G: This certificate allows donors, that is persons or organizations making donations to an 80G certified NGO, to avail deduction.

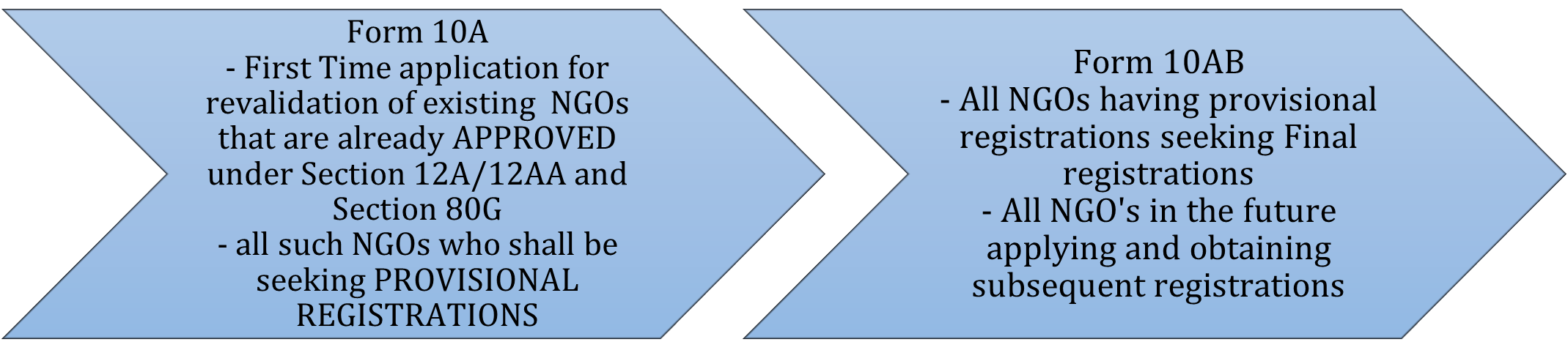

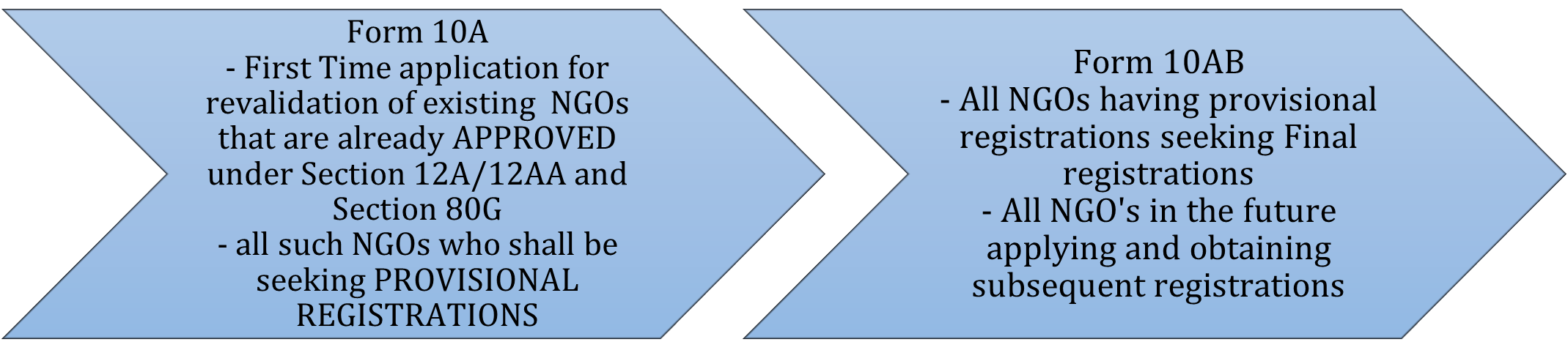

All the existing NGO’s having registration under section 12A and 80G of Income Tax, Act 1961 needed to reapply for the registration under Section 12AB;

All the new NGO’s seeking registration under Section 12A and 80G of Income Tax, Act 1961 needs to apply for registration under Section 12AB

Click here to know more about 80G & 12A for your NGO

Charitable Trusts / Section 8 Company / Societies seeking Foreign Contributions for definite cultural, educational, economic, religious or social program for the benefit of the society may obtain FCRA Registration or receive foreign contribution through “prior permission” route. Such NGO shall neither receive nor utilize any Foreign Contribution unless it has obtained either Registration or Prior Permission from the Central Government.

FCRA Registration:

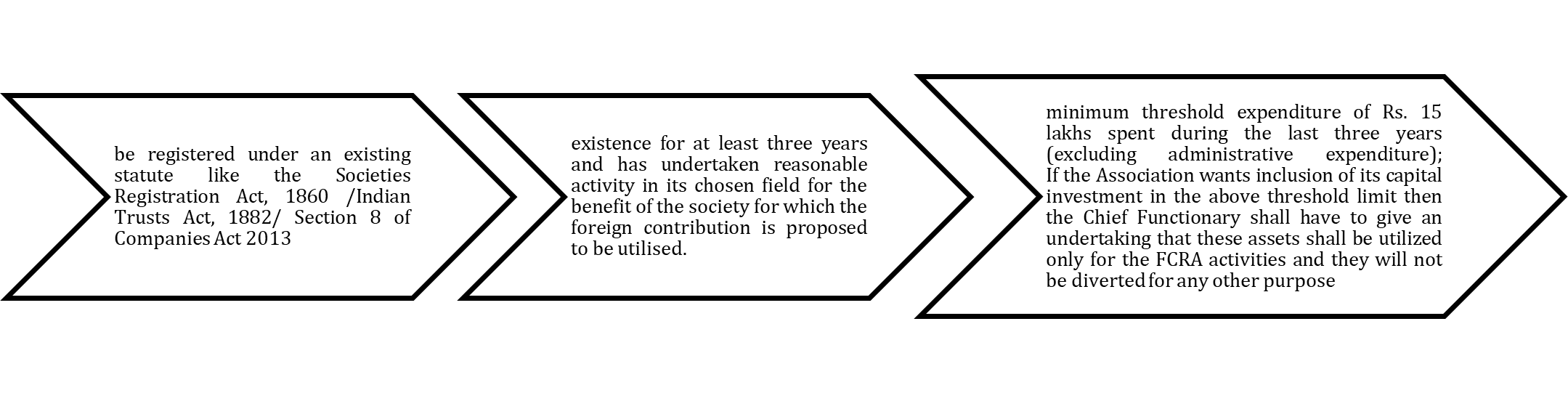

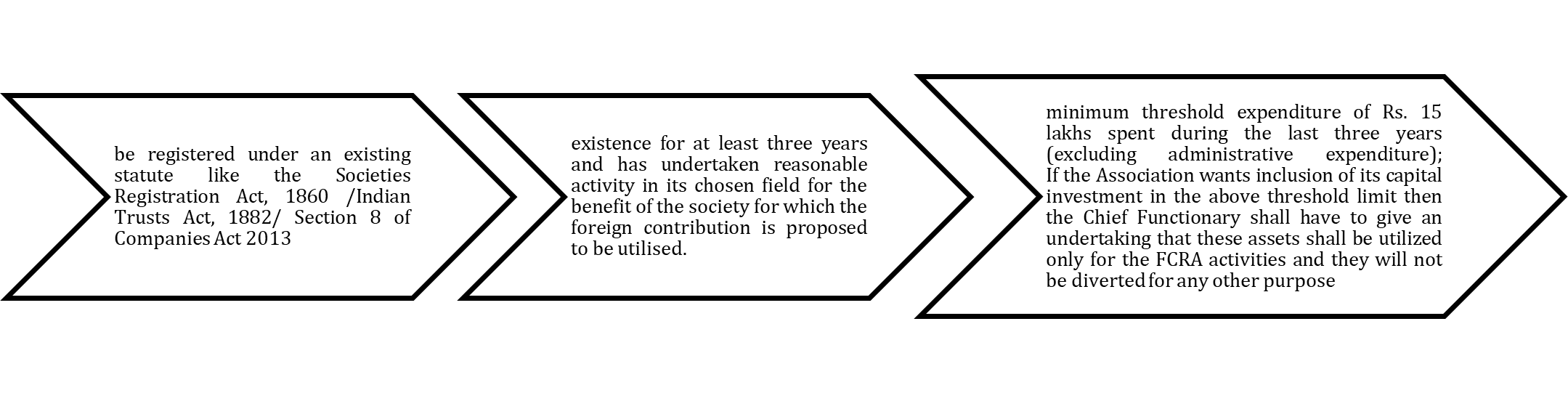

- Eligibility Criteria for FCRA Registration: Entity must be:

Prior Permission:

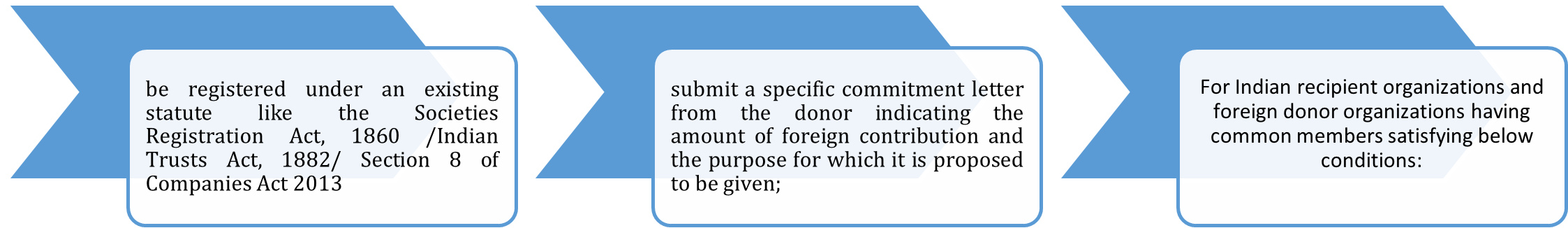

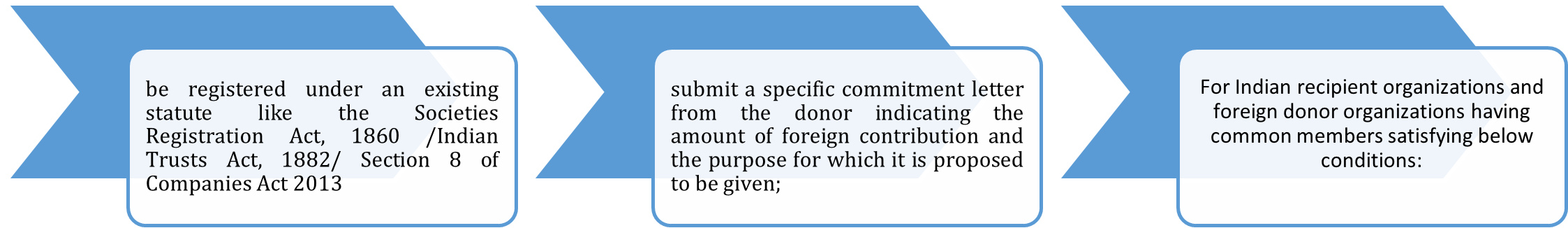

- Eligibility Criteria for Prior Permission: Entity must be:

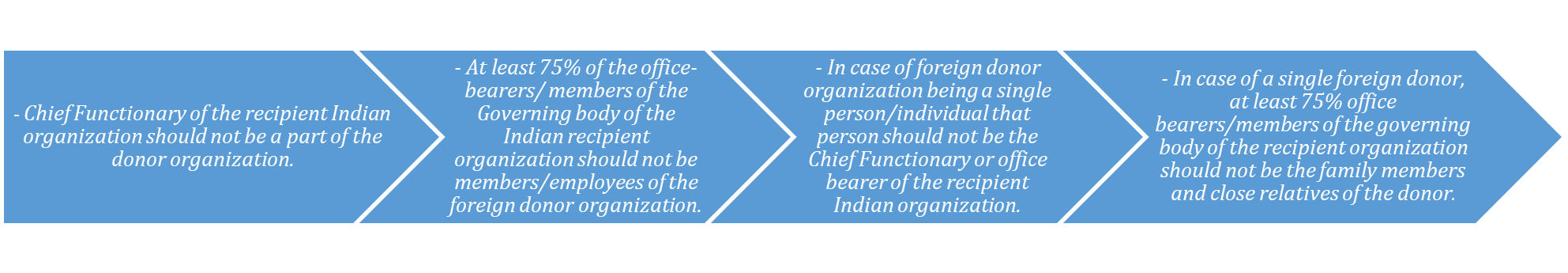

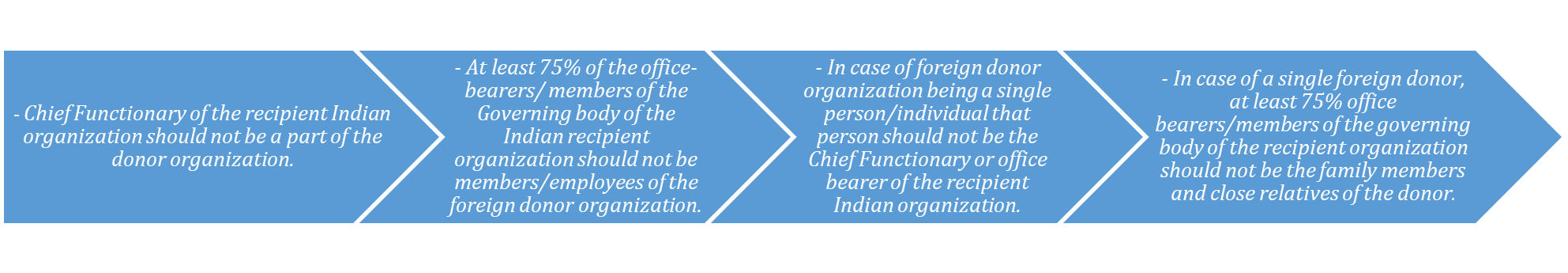

Indian recipient organizations shall satisfy the following conditions:

Click here to know more about FCRA Registration

- MANDATORY REGISTRATION OF CSR ENTITY:

Every eligible entity who intends to undertake any CSR activity, shall register itself with the Central Government by filing the Form CSR-1 electronically with the Registrar of Companies.

Documents Required

Self-Certified Copy of following documents:

- Certificate of Registration of the Entity;

- Incorporation Documents of the Entity i.e Trust Deed/ Memorandum of Association and Articles of Association/ Bye-Laws/ Rules and Regulations;

- PAN Card of the Entity;

- In case property is Rented- NOC from Landlord; In case of owned property – Utility Bill;

- FCRA Registration (if any);

- Existing order under Section 12A/ 12AA/ 12AB as the case may be;

- Order of Rejection of application under section 12A/12AA/12AB as the case may be;

- In case of existing entities: Annual Accounts of immediately preceding three years or since their inception;

- In case income of entity includes profits and gains of business u/s 11(4A)- Annual Accounts and Audit Report of immediately preceding three years or since their inception;

- Documents evidencing adoption or modification of the objects;

- Detailed list of activities undertaken by the entity;

- Details of Registration under Darpan Portal

- Any other document as may be asked by department.

Additional Documents:

- Pan Card and Aadhar Card (Voter ID/ Driving License/ Passport in case of no PAN/Aadhar) of all settlors/authors/trustees; Members of Governing Council/ Members of Society; Shareholders holding not less than five percent shares.

FCRA Registration:

- Certified Copy of Registration Certificate or Trust Deed or other registration document as the case may be;

- Details of activities during last three years;

- Audited Statement of Accounts for the last three Financial years (Assets and Liabilities, Receipt and Payment; Income and Expenditure);

- Affidavit executed by each office bearer and key functionary and member;

- Details of Registration under Darpan Portal

- 12AB Registration Certificate

For Obtaining Prior Permission:

- Certified Copy of Registration Certificate or Trust Deed or other registration document as the case may be;

- Commitment letter from foreign donor specifying the amount of foreign contribution;

- Copy of the project report for which foreign contribution is solicited/being offered;

- Affidavit executed by each office bearer and key functionary and member;

- Details of Registration under Darpan Portal

- 12AB Registration Certificate

CSR-1:

- Copy of Registration Certificate of the Entity;

- PAN of the Entity;

- DIN/ PAN of Trustee/ Secretary/ Director of the Entity;

- Digital Signature Certificate

- In case of Section 8 Company: Director;

- In case of Registered Public Trust: Trustee/ CEO;

- In case of Registered Society: CEO/ Chairperson/ Secretary;

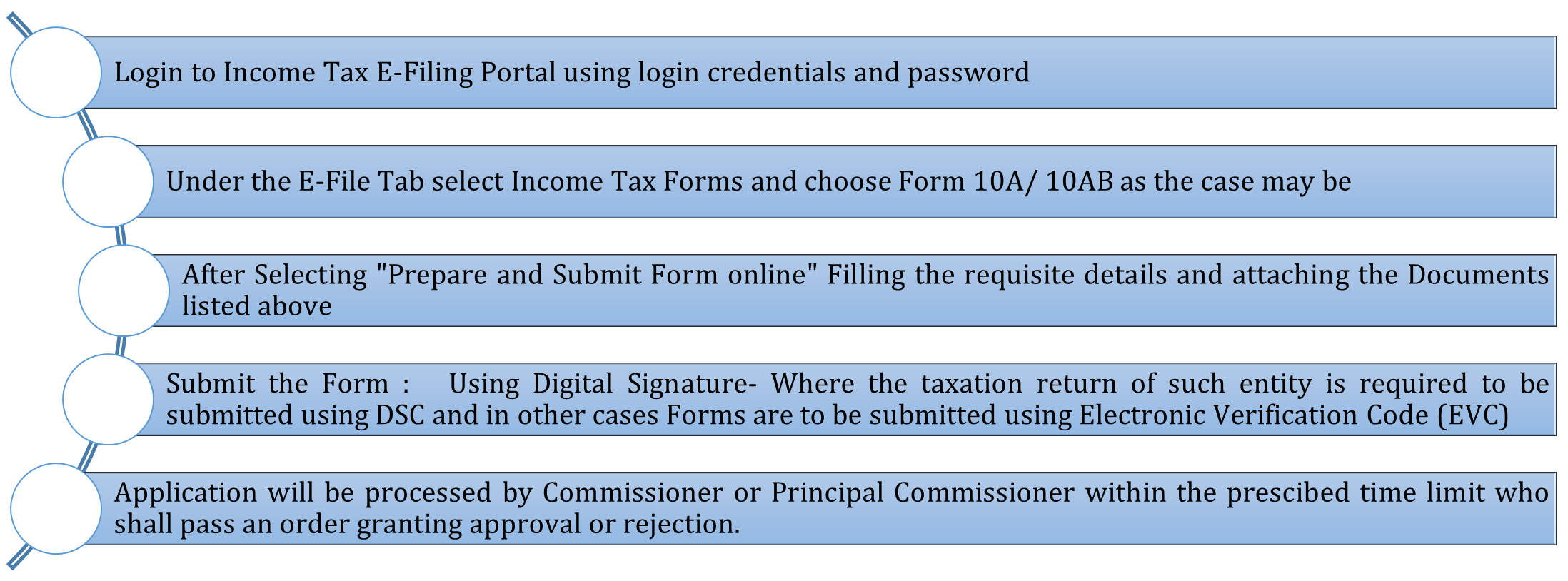

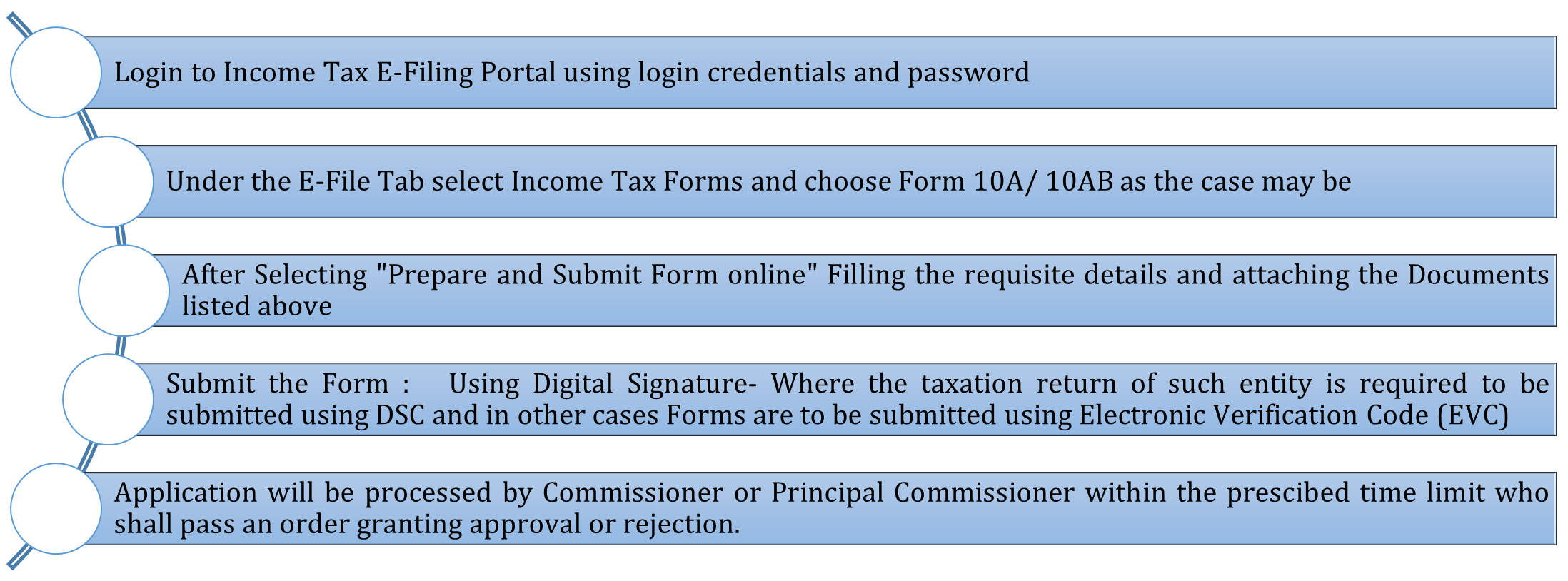

Procedure

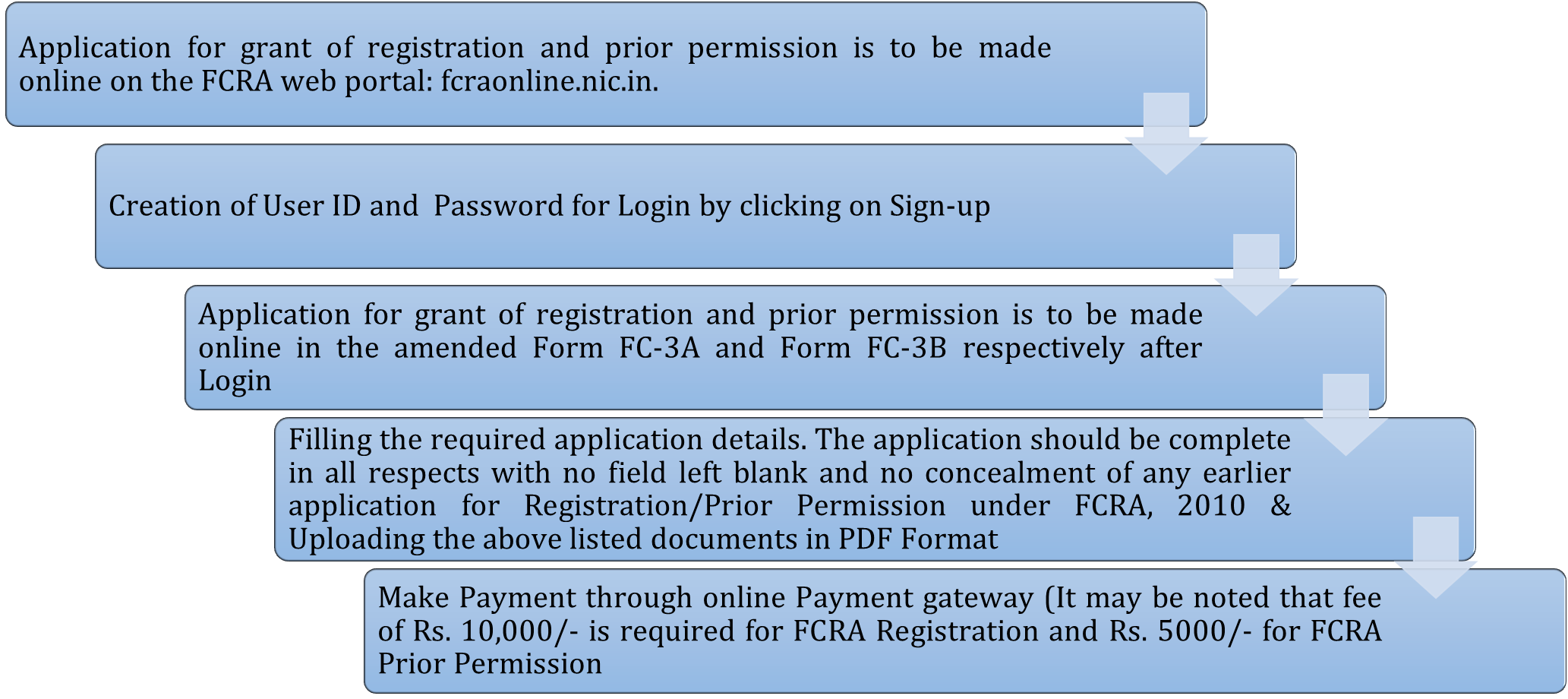

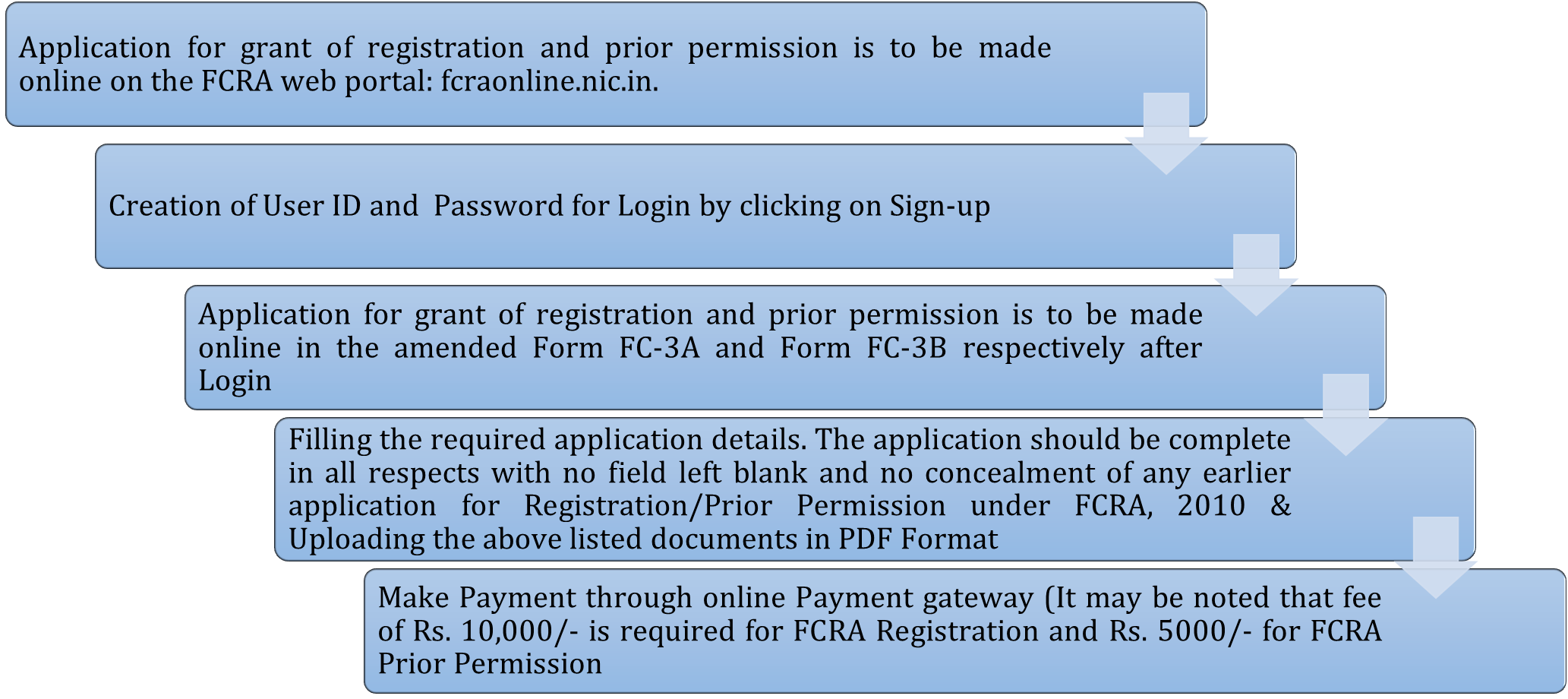

- FCRA Registration / Prior Permission:

FCRA Bank Account: It is mandatory to open an FCRA account in the State Bank of India (SBI), Main Branch located at Sansad Marg, New Delhi by each NGO/association seeking registration under FCRA, 2010.This “FCRA account” of the NGO would act as the first exclusive port of receipt of foreign contribution in India.

- CSR-1: (“Registration of Entities for undertaking CSR Activities”)

Filling of E-Form CSR-1: The Form can be downloaded from MCA Portal. The Form mainly consists of two parts, first part is relating to the information about the entity who undertakes CSR activities and Second Part is certification by Practicing Professionals;

- Nature of Entity (Clause-1): -

The information w.r.t type of entity i.e. whether it is Section 8 Company, or a registered public trust or a registered society etc.

- Establishment of Entity (Clause 2):

The Company may carry out CSR activities:

- Either singly or along with other Companies; (In this case, details of such Company/ group Company needs to be filled);

- Or through such entities (not established by the Company) and such entity must have track record of minimum three years in undertaking similar activities;

- Factual Information about the Entity (Clause 3 & Clause 4):

The details such as name, Date of Incorporation, Address, Email Id, PAN, Details of Directors/ Board of Trustees/ Chairman/ CEO/ Secretary/ Authorised Representatives of the entity, etc;

A declaration is to be given by the entity that the particulars given in the Form Clause 1 to Clause 4 are true and also are in agreement with the documents maintained by the entity and same needs to be digitally signed on behalf of the entity.

The e-Form CSR- 1 must also be certified by Practicing Professional.

The Form shall be signed and submitted electronically by the entity on MCA Portal. On the submission of Form CSR-1 on the portal, a unique CSR Registration number is generated by the system automatically.

FEATURES & BENEFITS

- Promotes Welfare of the Society by providing necessary Financial Assistance and other support;

- Separate Legal Identity;

- Tax Deductions to Donors under Section 80G of Income Tax Act, 1961;

- If such entity is registered under Section 12A of Income Tax Act, 1961 then its profits shall be entirely exempted and no tax will be levied on such entity;

- Such Entities are also eligible for receiving Corporate Social Responsibility (CSR) Funds and carry out CSR activities;

- Have Access to Government Funding;

- Limited Liability;

- Better Credibility and Recognition;

- National and International Collaborations;

- Eligible for receiving Foreign Contributions if registered under FCRA. etc;

- Eligible for receiving Government Grants and Government Aid

ROLE OF COMPLIANCE CALENDAR LLP: -

Non- Governmental Organizations works for the upliftment and betterment of the Society. It is eligible for receiving Government Funding, Private Funding, Tax Exemptions, CSR Funding as well as Foreign Contributions for promotion of its objectives. Team Compliance Calendar LLP consists of well experienced professional who can help you in getting various Registrations, Compliance for Government Grants as well as ensures that the NGO’s comply with all the statutory Compliances. Our team not only helps in the formation and registration of NGO but also to run, manage and achieve targeted goals by providing services such as Project Implementation, Fund Raising, Complying with Statutory requirements, Work Recognition, etc. For any support, you are welcome to reach out to us at info@ccoffice.in or connect at 9988424211.

Compliance Calendar ®

Compliance Calendar ®