Non-Governmental Organisation (NGO) as the term suggests, these organisations operates independent from the Government. It is a legally constituted Organisation created by natural and legal persons primarily registered for charitable or non-profit purposes, their mandate is to promote the public interest and serve the public good. NGOs are engaged in public services based on social, religious, spiritual, cultural, economic, ethical, etc. considerations. NGO’s are formed with defined aimed and objectives and intends to apply its profits, if any or other income in promoting its objects. In India, NGO’s can be registered as follows: -

Section 8 Company: A Company incorporated under provisions of section 8 of Companies Act, 2013 with the objective of promoting commerce, art, science, sports, education, research, social welfare, religion, charity, protection of environment or any such other objects, provided that the profits, if any, or other income are applied only for promoting the objectives of the Company and such Company intends to prohibit payment of any dividend to its members;

IMPORTANT POINTS IN CONNECTION WITH SECTION 8 COMPANY:

- A Partnership Firm may be a member of the Section 8 Company;

- A Section 8 Company cannot alter its Memorandum of Association/ Articles of Association except with the previous approval of Central Government;

- A Section 8 Company shall amalgamate only with another section 8 Company having similar objects;

- The Company is registered without paying any stamp duty on its MOA and AOA.

Trust: A Trust is a relationship in which a person or entity holds a valid legal title to a certain property which is known as the Trust property. The Trust is bound by a fiduciary duty to exercise that legal title for the benefit of Beneficiaries. The trust shall be governed by the terms of written trust agreement.

There are generally two types of trust in India:

- Private trusts: Private trusts are regulated by the Indian Trusts Act, 1882

- Public trusts: Public trusts are classified as Charitable and religious trusts.

The relevant legislations for the recognition and enforceability of public trusts are:

- The Charitable and Religious Trust Act, 1920,

- the Religious Endowments Act, 1863,

- the Charitable Endowments Act, 1890,

- the Societies Registration Act, 1860,

- the Bombay Public Trust Act, 1950,

- Trusts can also be used as a vehicle for investments, such as venture capital funds and mutual funds. Such type of trusts is governed by Securities and Exchange Board of India (SEBI).

Society: A Society is association of persons coming together by their mutual consent to determine, deliberate and act jointly for a common purpose, societies are usually registered for promotion of charitable activities like education, art, religion, music, sports, culture, etc

- Governing Laws for Registration of NGO’s in India:

- Section 8 of Companies Act 2013;

- State Trusts Act and Indian Trust Act, 1882;

- Societies Registration Act, 1860;

Documents

- For Registration of Section 8 Company:

- Proof of Office Address of the registered office along with NOC (Conveyance / Lease deed/ Rent Agreement etc. along with rent receipts) and Copy of utility bills (not older than 2 months)

- Identity Proof:- (Voters Identity Card/ Passport/ Driving License.);

- Address Proof: - (Bank Statement / Electricity Bill/ Telephone bill/ Mobile bill) and PAN Card of First Director and Subscribers not having valid DIN;

- Estimated Future Income and Expenditure of the Company for next three years specifying the sources of Income and Objects of Expenditure;

- A declaration by Practicing Chartered Accountant/ Company Secretary/Cost Accountant/ Advocate in Form INC-14 stating that MOA & AOA have been drawn up in conformity with Section 8 and requirements of Act and Rules relating to registration of section 8 Company has been complied with;

- Declaration by each of the person making application; Such declaration shall be in Form INC-15.

- Memorandum of Association (MOA) and Articles of Association (AOA).

- DIR-2 (Consent to Act as Director) & Disclosure of Interest in other entities

Documents required for Agile Pro:

- Identity Proof and Address Proof of Authorised Signatory for opening of Bank Account;

- Specimen Signature for EPFO of Directors

- Passport Size Photographs of First Directors.

Click here to know in detail about Section 8 Company Registration

For Registration of Trust:

- Trust Deed (One Original and one photocopy); (The photocopy of deed should also contain signature of settlor on all pages)

- Proof of identity of the settler (Aadhaar card, passport, voter ID, driving license or any such photo ID) [Self attested];

- Proof of identity of each trustee (Aadhaar card, passport, voter ID, driving license or any such photo ID) [Self attested];

- Passport size photographs of Settler and Trustees ;

- Proof of the registered office address of the Trust (Water bill/ Electricity Bill or registration certificate);

- Non Objection letter signed by the landowner;

At the time of registration, the settlor and witnesses must be personally present with their identity proof in original. To know more in detail about Trust Registration, click here.

For Registration of Society:

- Covering Letter mentioning the objective/ purpose for which the society is being formed signed by all the founding members of the society;

- PAN Card and Residence Proof (Bank Statement/ Aadhaar Card/ Utility Bill/ Driving License/ Passport) of all the members of the proposed society;

- Proof of registered office address of the society along with a NOC from the landlord if any has to be attached;

- Certified and duplicate copy of Memorandum of Association & Bye Laws signed by all establishing members;

- List of all the members containing their name, occupation and address of governing body along with their signatures;

- Declaration by the President of the proposed society that he is willing and competent to hold the said post; and A sworn affidavit from the President or Secretary, declaring the relationship between the subscribers.

- Minutes of the meeting (general body meeting conducted to set the rules and regulations of the society).

Click here to know in detail about Society Registration.

Procedure

- FOR REGISTRATION OF SECTION 8 COMPANY:

- CHECKPOINTS:

- In case Company to be formed as Private Company: Minimum 2 Directors & Members;

- In case Company to be formed as Public Company: Minimum 3 Directors & 7 Members;

- Digital Signature Certificates (DSC) of First Director and Subscribers;

- Upto Three DIN can be obtained for the First Directors of the proposed Company not having DIN;

The promoters must decide on the following before Formation of Company

- Name of the Proposed Company;

- Objects to be carried by the Company;

- Authorised Capital and Paid Up capital;

- Number of subscribers; Number of Directors and Number of shares to be subscribed by each subscriber;

- Registered Office of the Proposed Company;

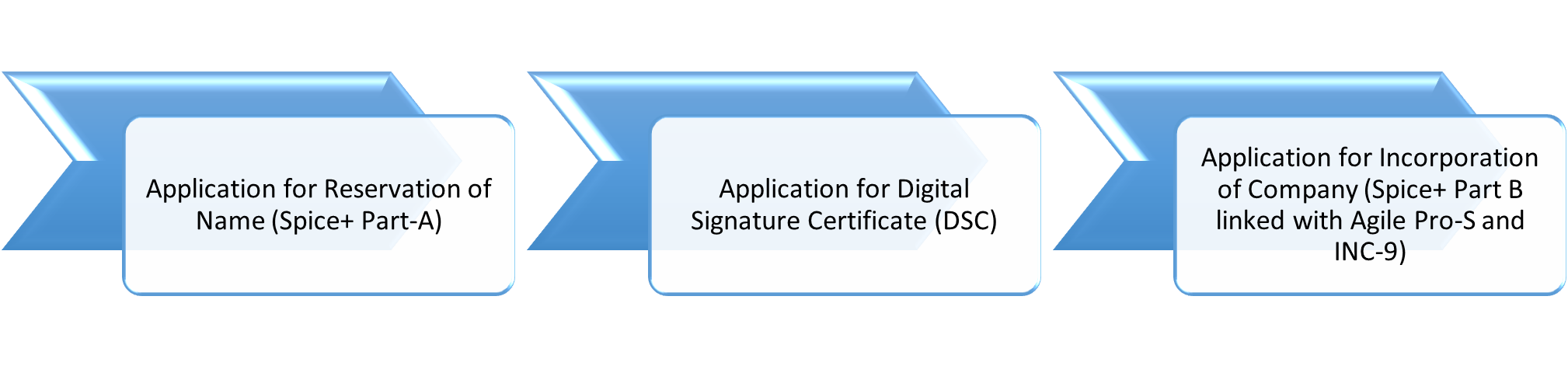

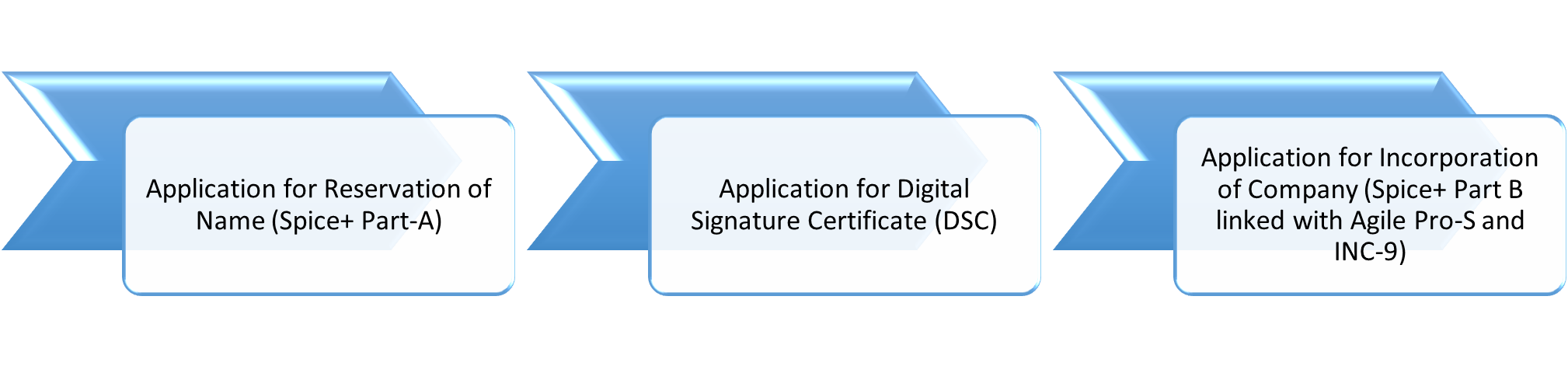

Name Reservation:-

- Two names in order of preference can be proposed;

- The name proposed shall comply with provisions of Rule 8 of Companies (Incorporation) Rules, 2014;

- The name of the Proposed Company shall include the words Foundation, Forum, Association, Federation, Chambers, Confederation, Council, Electoral trust and the like etc.;

Application for Digital Signature Certificate: -

- Obtain a Digital Signature Certificate (DSC) from the authorised DSC issuing authority for the First Directors and Subscribers, if such persons do not have DSC;

Application for Incorporation of Company: -

An application for Incorporation of Section 8 Company is required to be made in Spice+ Part B (Form INC-32) linked with Agile Pro- S (Form INC-35) and Form INC-9 (Declaration form from First Director and Subscribers) along with the above listed documents as attachments to these form.

Click here to know in detail about Section 8 Company Registration

- FOR REGISTRATION OF TRUST:

- CHECKPOINTS:

Before registration of trust following aspects have to be decided in relation to trust:-

- Name

- Address

- Objects (Charitable/ Religious)

- One settler

- Two trustees

- Property whether movable/ immovable

- CREATION OF TRUST DEED:

- A trust deed generally incorporates the following:-

- the name(s) of the author(s)/settlor(s), trustee(s); beneficiary/ies or whether it shall be the public at large;

- the name by which the trust shall be known; the object and purpose of the trust; principal or other offices of trust; the property that shall devolve upon the trustee(s) under the trust for the benefit of the beneficiary/ies;

- an intention to divest the trust property upon the trustee(s);

- the procedure for appointment, removal or replacement of a trustee, their rights, duties and powers, etc, the rights and duties of the beneficiary/ies;

- the mode and method of determination of the trust.

- Execution of Trust Deed: The trust deed must be executed on stamp paper of appropriate value, depending on the stamp duty applicable in state of execution. The deed should be signed by Settlor, Trustees and witnessed by Atleast two witnesses;

- Registration of Trust Deed:

The above listed documents are required to be submitted in a Sub-Registrar office paying registration charges.

Click here to know more about Trust Registration

- FOR REGISTRATION OF SOCIETY:

- Checkpoints:

- Minimum 7 or more persons required for formation of society;

- Society registration is maintained by state governments. Thus, the application for society registration must be created to the specific authority of the state, where the registered office of society is situated.

The Name shall not:

- be similar or identical with the name of existing society registered;

- suggest any patronage of State Government or Government of India;

- contravene provisions of Emblem and Names Act, 1950

- Preparation of Memorandum of Association & Bye Laws:

Details contained in Memorandum of Association:

- The work and the objectives of the society for which it is being established;

- The details of the members forming the society;

- Address of the registered office of the society;

Details contained in Bye-Laws:

- Rules and Regulations for working of the society;

- Maintenance of day to day activities;

- Details of Meetings of the society, frequency of meetings, manner in which meetings to be held;

- Information about Auditors;

- Forms of Arbitration in case of any dispute between the members of the society;

- Ways for dissolution of society.

The above listed documents are required to be submitted to the Registrar of Societies along with the requisite fees in two copies.

Click here to know in detail about Society Registration.

Features & Benefits

Section 8 Company:

- Various Exemptions under Companies Act, 2013;

- Numerous Tax Exemptions;

- No Stamp Duty payable for Registration;

- Not required to add suffix “Limited” or “Private Limited” after its name;

- Separate Legal Entity, Perpetual Succession and Limited Liability;

- No Minimum Capital Requirement;

- More Recognition, thus benefits in getting more donations from Public for promotion of its objects, etc.

Trust:

- Separate Legal Status;

- Easy Management;

- Numerous Tax Exemption;

- Long- Run Organisation;

- Statutory Rights; and

- Option to amalgamate/ merge with other Public Charitable Trusts having similar objects subject to certain compliances etc.

Society:

- Registration and Formation Process is simple;

- Compliance Cost is low;

- Regulatory Interference is less;

- Minimum Record- Keeping Requirements;

- Compliance with Regulations is easy;

- Tax Exemptions due to charitable nature of operations;

ROLE OF COMPLIANCE CALENDAR LLP

NGO’s play a significant role in development of community, state as well as nation. The role of NGO’s has gained a wider prominence; their object is benefiting the society at large. Compliance Calendar LLP consists of team of well experienced NGO Professionals who will help you in Formation and Registration of NGO. It is important to choose the right type of NGO, as there exists a separate law for registering different kinds of Organisation. Our Team will help you to choose the suitable option for registration of NGO depending upon the objective, purpose and need of forming an NGO. We will not only help you in Formation and Registration of NGO but also to run, manage and achieve targeted goals by providing services such as Project Implementation, Fund Raising, Complying with Statutory requirements, Work Recognition, etc. If you need consultation in running your NGO, you are welcome to connect with us at info@ccoffice.in | 9988424211.

Compliance Calendar ®

Compliance Calendar ®