Many of us don’t know that it is also a mandatory requirement under State law. You can pay stamp duty online on Share Certificates and print e-Stamp certificate from the convenience of their home for NCT of Delhi, Karnataka, Himachal Pradesh and UT of Ladakh. Like in Delhi this facility is providing by SHCIL at https://www.shcilestamp.com/estamp_share_issuance.html

This facility is to be utilised by companies towards payment of Stamp Duty on issuance of New Shares Certificates. This facility implemented for the Jurisdiction of NCT Delhi only at given site of SHCIL. E-Stamping of Share Certificate comes under the purview of state governments as per the consolidated stamp duty u/s 9(1)(b) of the Indian Stamp Act, 1899.

The companies desirous of availing this facility of online stamp duty payment through this payment portal can register online through its Professional like CA/CS/CMA/LAWYER and proceed further. Here we CCL can help to get it done your E-Stamping on Share Certificate and make your Company fully compliant in the eyes of law. This also help in making transparent relation between the Company as well and Shareholders.

In the Simple process we CCL will brief you that as a First Step companies after making login will populate the relevant details of the new shares issued against which stamp duty payment to be made.

Subsequently thereafter the details will be validated by Govt. officials & challan will be issued to the companies against which Stamp Duty payment is to be remitted.

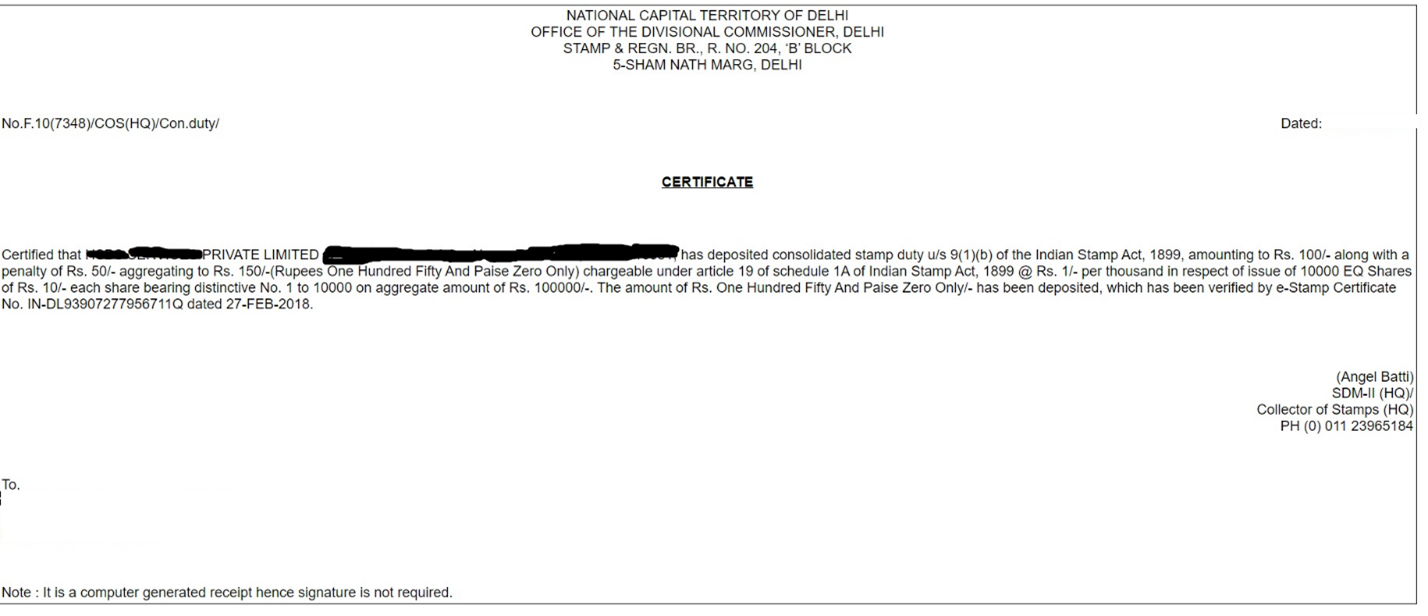

The process will close with the issuance of e-Stamp Certificate by STOCKHOLDING to the company on receipt of the stamp duty payment and the said certificate is to be collected from the nearest Branch of Stock Holding Delhi. CCL will show you that This SHCIL Certificates how’s it looks like –

ATTACHED SAMPLE

Documents

Documents required for Application for consolidated payment of stamp duty on share certificates

Note : Only PDF file can be attached.

- Form 2/PAS 3(Submitted at MCA) & Challan paid

- Copy of Share certificate

- List of allottees and Shareholding pattern

- Copy of board or shareholder’s resolution

- Resolution authorizing the issue of further shares capital.

- Certificate of previous stamp duty paid (if any).

- Certified copy of Certificate of Incorporation

- Certified copy of Memorandum of Association & AOA

- Power of attorney (POA) to present the matter;

- Certificate by Practicing Professional will only be required if company is not providing DIN with PAN of the director in details while submitting the application online

While filing documents please note-

1. Certified that all the aforesaid mentioned documents attached are copy of original and true copy of records of company.

2. All documents should be Digitally Signed by Company Director / Authorized Signatory of the Company.

3. If Stamp Duty is less paid then stamp duty payer is liable for penalty / punishment as per Indian Stamp Act.

Procedure

- Company Once allot Shares (mode can be anything) must issue the Share Certificates within 60 days from the date of allotment;

- Hold Board Meeting pass the Resolution for the filing an application to SHCIL for payment of Stamp duty on issuance of Share Certificate;

- Authorised signatory has to make an application to the concerned Collector of Stamps (SDM).

- Prepare all draft documents or Application along with its Annexures required;

- Visit website https://www.shcilestamp.com/OnlineService/ and Create account;

- File or Submit An application along with Copy of Share Certificate, documents as annexures to this Application;

- After submitting the application, Reference Number will be generated and can check the status from time to time;

- After due scrutiny of all papers/documents submitted with the SDM, SHCIL will issue a challan mentioning therein amount to be paid in treasury.

- After depositing asked amount, he will get confirmation from the Treasury Officer about the receipt of amount.

- After verification, Collector of Stamp will issue a E-certificate (System generated) mentioning therein that the applicant company has paid the due consolidated stamp duty

Compliance Calendar ®

Compliance Calendar ®