When discussing the Recovery of Shares, individuals often encounter challenges related to KYC updates, issuance of duplicate share certificates, or transmission of shares in scenarios involving the loss or the death of shareholders.

The transmission of shares is a process that occurs when the ownership of shares is transferred from a deceased shareholder to their legal heirs or beneficiaries, the process involves legal steps under section 56 of the Companies Act 2013 and requires the submission of specific documents to the company's Registrar and Transfer Agent (RTA), may require documentary evidence to prove the identity of the legal heir or other claimants, such as PAN Card, Passport, Ration Card, Voter’s Identity Card, etc.

The term “transmission” refers to the devolution of title to shares otherwise than by transfer. When shares are transmitted, the person to whom the shares are transmitted becomes the registered shareholder of the company and is entitled to all rights and subject to all liabilities attached to the shares. Transmission of shares should be affected by the company upon receipt of an intimation of the death of a member and on the production of necessary documents. If the deceased held shares in more than one company, the legal heir(s) or nominee must correspond with each company by submitting relevant documents along with the share certificates to affect the transmission of share

Steps and Documents Required for the Transmission of Shares

Obtain Death Certificate

The first step is to obtain the death certificate of the deceased shareholder. This document serves as proof of death and is essential for initiating the transmission process.

Identify Legal Heirs or Beneficiaries

Identify and establish the legal heirs or beneficiaries entitled to the shares. This may involve obtaining legal heir certificates or other relevant documents from the authorities.

Contact the Registrar and Transfer Agent (RTA) of the Company

Inform the registrar and transfer agent (RTA) of the company whose shares are being transmitted about the death of the shareholder. The RTA is responsible for managing share transfers.

Provide Necessary Documentation

Death certificate of the shareholder.

Transmission request forms (as provided by the RTA).

Probate of will certificate, letter of administration, succession certificate, or legal heir certificate (as applicable).

Affidavit of the legal heirs and indemnity bond.

Any other documents specified by the company or RTA.

Submit the required documents to the RTA.

Transfer of Shares

Once the documentation is submitted and verified, the shares are transferred to the names of the legal heirs or beneficiaries as per the instructions provided.

Update Shareholder Records

The company updates its shareholder records to reflect the changes in ownership.

Payment of Stamp Duty

In some jurisdictions, stamp duty may apply to the transmission of shares. Ensure that any required stamp duty is paid.

Detailed Documentation and Procedures

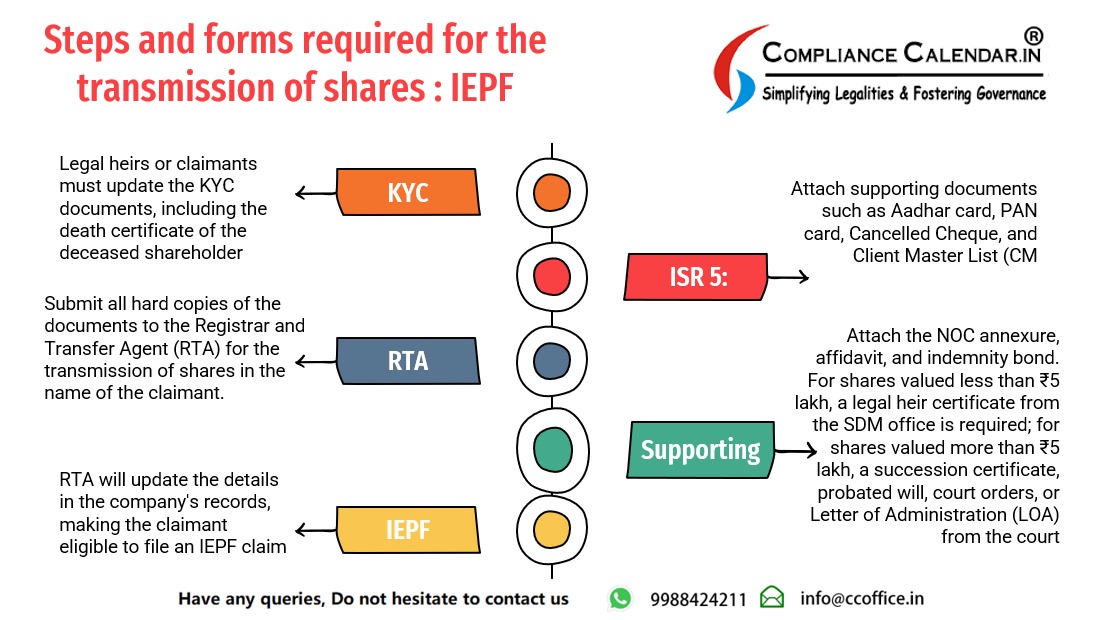

Necessary Steps and Forms Required for Transmission of Shares

Update KYC Documents

Update the KYC documents of the legal heirs or claimants and provide the death certificate of the deceased shareholder.

Form ISR 5

Fill out and submit Form ISR 5.

Supporting Documents

-

Aadhar card.

-

PAN card.

-

Cancelled cheque.

-

Client Master List (CML).

-

Attach supporting documents of the legal heirs.

NOC Annexure

Attach the No Objection Certificate (NOC) annexure.

Affidavit and Indemnity Bond

Submit an affidavit and an indemnity bond.

Legal Heir Certificate/Succession Certificate

-

If the value of shares is less than Rs.5 lakhs, a legal heir certificate from the SDM office is required.

-

If the value of shares is more than Rs.5 lakhs, a succession certificate, probated will, court orders, and a letter of administration (LOA) from the court are required.

Submission to RTA

Submit all hard copies of documents to the Registrar and Transfer Agent (RTA) for the transmission of shares in the name of the claimant.

RTA Updates

The RTA will update the details in the company’s records.

IEPF Claim

The claimant will then be eligible to file the IEPF claim.

Legal Heir Certificate

A legal heir certificate is required when the original shareholder is deceased, and the value of shares is below INR 5 lakhs.

Procedure to Obtain a Legal Heir Certificate

-

Purpose

Obtain for the death of the shareholder.

-

Application Form

Fill out the application form and attach supporting documents such as the death certificate of the deceased, the legal heirs' Aadhar card, PAN card, and relationship proof.

-

Details of Legal Heirs

Define the relationships and details of legal heirs.

-

Government Verification

Issued by government authorities after verifying the details of the deceased person.

-

Usage

Used to claim shares valued below Rs.5 lakhs.

Succession Certificate

A succession certificate is required when the original shareholder is deceased, and the value of the shares is:

-

Above Rs.5 lakhs in physical shares.

-

Above Rs.15 lakhs in demat shares.

Procedure to Obtain a Succession Certificate from Court

-

Prepare Required Documents

Collect necessary documents.

-

File Petition

File the petition in court along with supporting documents such as the death certificate of the deceased, the legal heirs' Aadhar card, PAN card, and relationship proof.

-

Court Hearing and Publications

Attend court hearings and ensure publications.

-

Handle Objections

Address any objections raised.

-

Issuance

Obtain the succession certificate from the court.

-

Submission to RTA

Submit the succession certificate to the RTA and the company to claim the unclaimed shares of the deceased shareholder.

Timeline for Transmission of Shares

-

With Legal Heir Certificate: The transmission process takes approximately 5 to 8 months or more.

-

With Succession Certificate: The transmission process takes approximately 7 to 9 months or more, depending on the issuance of the succession certificate from the court.

Name Deletion

When shares are held in the Joint name, the share certificate refers to removing/deleting the Joint holder’s name after his death then the name deletion task arises.

Required Document:

-

Death Certificate of deceased shareholder

-

Remaining Shareholder’s Aadhar card

-

Remaining shareholder’s PAN card

-

Original leaf Cancel Cheque

-

CML (Client Master List) of demat account

Conclusion

Under the Companies Act, 2013, the transmission of shares involves the transfer of ownership to legal heirs or beneficiaries upon the death or insolvency of a shareholder, process is governed by Section 56 and other relevant provisions, ensuring that companies register the transfer upon receipt of necessary documents and intimation. Whether due to death or loss or other cases, the process requires meticulous documentation, including death certificates, legal heir certificates, or court orders where applicable. In this article, Compliance Calendar LLP has tried to cover the intricacies of the transmission process and the necessary document requirements with unclaimed shares. Companies may streamline procedures through their Articles of Association, such as provisions akin to Regulation of Table A of Schedule I, facilitating efficient transmission of shares under varying circumstances.

If you still have any questions, do not hesitate to reach out to info@ccoffice.in

_crop6_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_Second_Amendment_Rules,_2025_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_learn_crop10_thumb.jpg)

_rd_roc_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)