Appointment of Directors as Independent Directors (IDs) play a major role in corporate governance by ensuring transparency, protecting shareholder interests, and overseeing the board’s decision-making. The Companies Act, 2013, has stringent provisions regarding their appointment, role, and remuneration. Unlike executive directors, Independent Directors cannot receive stock options and their compensation is primarily limited to fees, reimbursement of expenses, and profit-based commissions. However, the March 2021 amendment introduced a significant change, allowing companies to compensate IDs even in the absence of profits.

This article provides a detailed analysis of the legal framework governing Independent Directors' remuneration, the impact of recent amendments, and practical considerations for companies while deciding the amount of Independent Director’s remuneration.

Legal Framework Governing Remuneration of Independent Directors

The remuneration of Independent Directors is governed by:

-

Section 149(9) of the Companies Act, 2013

-

Section 197 (including the March 2021 amendment)

-

Schedule V, Part II of the Act

-

SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015 (for listed companies)

1. Prohibition on Stock Options

Under Section 149(9) of the Companies Act, 2013, Independent Directors are not entitled to stock options (ESOPs). This restriction ensures that the Independent Director will remain unbiased and independent, free from any financial incentives related to stock price increase and other benefits related to this.

2. Permissible Modes of Compensation

Independent Directors can receive these compensation:

-

Sitting Fees: As per section 197(5) of Companies Act, 2013 a company may pay a sitting fee to a director for attending meetings of the Board or committees thereof, such sum as may be decided by the Board of directors thereof which shall not exceed one lakh rupees per meeting of the Board or committee thereof.

Provided that for Independent Directors and Women Directors, the sitting fee shall not be less than the sitting fee payable to other directors.

-

Reimbursement of Expenses: Costs incurred for attending meetings, including travel and lodging, can be reimbursed.

Before the March 2021 amendment, Independent Directors could only receive commissions if the company had sufficient profits. If the company had inadequate or no profits, it was legally restricted from paying them.

Companies (Amendment) Act, 2020

Companies (Amendment) Act, 2020 (Effective from 18th March 2021): A Game Changer

1. Key Changes Introduced

The Companies (Amendment) Act, 2020, which came into effect in March 2021, modified Sections 149(9) and 197(3), along with changes in Schedule V, Part II. These amendments enabled companies to pay remuneration to Independent Directors even in cases where they had no or inadequate profits. The changes allow Independent Directors to receive fixed remuneration, just like executive directors, subject to the limits specified under Schedule V.

2. Impact on Sections of the Companies Act

Section 149(9): Specifies that an independent director shall not be entitled to any stock option and may receive remuneration by way of fee provided under sub-section (5) of section 197, reimbursement of expenses for participation in the Board and other meetings and profit related commission as may be approved by the members, section still prohibits stock options but allows IDs to be compensated under the revised Section 197(3).

Section 197(3): Now allows companies to pay remuneration to Independent Directors even if profits are inadequate or absent.

Schedule V, Part II: Specifies the remuneration by companies having no profit or inadequate profit limits applicable on other directors which is similar to how executive directors are compensated in loss-making companies.

3. Why Was This Amendment Necessary?

-

To attract high-quality professionals to serve as Independent Directors.

-

To ensure fair compensation even when companies face financial distress.

-

To align with global corporate governance practices.

Before this amendment, Independent Directors were reluctant to serve in companies undergoing financial difficulties due to the absence of guaranteed compensation.

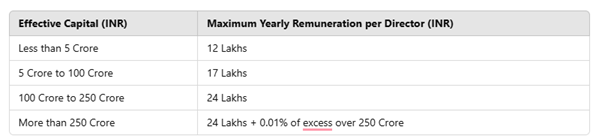

Remuneration Limits Under Schedule V

Applicable Limits When a Company Has Inadequate or No Profits

If a company does not have sufficient profits, it can pay remuneration to Independent Directors within the limits set under Schedule V, Part II:

Companies exceeding these limits must obtain shareholder approval by passing a special resolution.

Adjudication Order Issued by ROC-Kolkata Under Section 197 -Seva Parmodharmah Samjik Nidhi Limited

In Seva Parmodharmah Samjik Nidhi Limited,concerned ROC had issued an adjudication notice dated 19/12/2023 for violation of section197of the Act to the company and its officers.

Provision:-

Section 197 of the Companies Act, 2013 which governs the overall managerial remuneration payable by a public company to its directors, including the managing director, whole-time directors, and key managerial personnel. It stipulates that the total remuneration shall not exceed 11% of the net profits of the company in a financial year. The section also prescribes the remuneration payable to any one managing director; or whole-time director or manager shall not exceed five per cent. of the net profits of the company and if there is more than one such director remuneration shall not exceed ten per cent. of the net profits to all such directors and managers taken together. The remuneration payable to directors who are neither managing directors nor whole-time directors shall not exceed: -

(A) one per cent. of the net profits of the company, if there is a managing or whole-time director or manager.

(B) three per cent. of the net profits in any other case.

Fact of the Case:-

The company has contravened the provisions of the section 197 and for that concerned ROC had issued an adjudication notice dated 19/12/2023 for violation of section 197 of the Act to the company and its officers.

Imposed Penalty

The ROC after considering the fact and circumstances of the case levied penalties. The penalty amount was determined based on the auditor’s failure to comply with the relevant legal requirements. The details of the penalty, are as follows:-

|

Financial Year |

To whom penalty imposed |

Total maximum penalty |

|

2018-19 |

On Company |

5,00,000 |

|

1st Officer in default |

1,00,000 |

|

|

2nd Officer in default |

1,00,000 |

|

|

3rd Officer in default |

1,00,000 |

|

|

2019-20 |

On Company |

5,00,000 |

|

1st Officer in default |

1,00,000 |

|

|

2nd Officer in default |

1,00,000 |

|

|

3rd Officer in default |

1,00,000 |

Additional Conditions for Payment

To ensure transparency and prevent misuse, remuneration under Schedule V is subject to:

-

Approval from Nomination and Remuneration Committee (NRC) (if applicable).

-

Disclosure of remuneration details in the Board's Report.

-

Compliance with SEBI LODR Regulations for listed companies.

SEBI Regulations on Independent Directors’ Remuneration

For listed companies, SEBI’s LODR Regulations, 2015 further govern Independent Directors’ remuneration:

-

Regulation 17(6)(a): The board of directors shall recommend all fees or compensation, if any, paid to non-executive directors, including independent directors and shall require approval of shareholders in a general meeting.

-

Regulation 17(6)(b) The requirement of obtaining approval of shareholders in general meeting shall not apply to payment of sitting fees to non-executive directors, if made within the limits prescribed under the Companies Act, 2013 for payment of sitting fees

This specifies that an Independent Director can be paid its sitting fees without approval of shareholder subject to compliance of Companies Act, 2013

-

Regulation 17(6)(c): Non Executive Director in listed entities can receive up to 50% of the total annual remuneration payable to all non-executive directors as their remunaration subject to approval of shareholders of the company by way of special resolution.

-

Mandatory Shareholder Approval: If the criteria specified under Schedule V, this deviation from standard compensation structures must be approved by shareholders as per limits specified under Section 197 of Companies Act 2013

-

SEBI also mandates enhanced disclosures on Independent Directors’ remuneration in annual reports.

Practical Implications for Companies

1. For Companies with Profits

With a consolidated view after taking interpretation of all legal provisions Companies can pay Independent Directors sitting fees, expense reimbursements. Whoever Independent Director’s Remuneration is subject to Section 197 and Schedule V, which caps total managerial remuneration at 11% of net profits.

2. For Companies with No or Inadequate Profits

Fixed remuneration is now permitted under Schedule V, Part II. This can be done after taking Board approval and shareholder consent by passing a special resolution, in case the if it is exceeding limits prescribed under the act.

Companies should maintain transparent disclosures of their remuneration structures and it shall also be disclosed under the annual report of the company.

3. Key Considerations for Boards and Nomination and Remuneration Committee

- Fair and Justifiable Compensation: Companies must ensure Independent Directors are fairly compensated but not excessively overpaid.

-

Performance-Based Remuneration: IDs should be rewarded based on their contributions to governance and risk oversight.

-

Regulatory Compliance: Boards must stay updated on SEBI and MCA guidelines to prevent non-compliance.

The March 2021 amendment to the Companies Act, 2013, was a landmark move that addressed the longstanding issue of compensating Independent Directors in loss-making companies. By allowing remuneration even in cases of inadequate or no profits, the amendment makes Independent Directorships more attractive and ensures fairness in governance roles.

While the prohibition on stock options remains intact, the ability to pay fixed remuneration within prescribed limits significantly enhances corporate governance. Companies must strike a balance between fairness and accountability, ensuring that Independent Directors receive adequate compensation for their expertise while maintaining transparency and compliance.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)