As part of Recovery of Shares process, updating KYC is a Mandatory part, especially for unclaimed shares managed by the IEPF. According to SEBI regulations, it is mandatory to update KYC details with both companies and their Registrars and Transfer Agents (RTAs). Compliance Calendar LLP will guide you through the essential KYC updation process before proceeding with the share recovery.

The Securities and Exchange Board of India (SEBI) has instituted a framework to streamline the recovery of shares from the Investor Education and Protection Fund (IEPF), an initiative aimed at safeguarding investor interests and ensuring transparent processes in recovering unclaimed shares and dividends. SEBI mandates that all legitimate stockholders and investors must furnish their PAN, KYC information, and banking details, including a sample signature. This information is needed for verifying ownership and facilitating the recovery of shares.

Completing KYC updation is necessary for shareholders aiming to recover unclaimed shares from the IEPF, ensure compliance with regulatory requirements, and safeguard shareholder interests. By following these steps and working closely with the RTA and trusted service providers, shareholders can navigate the process smoothly and secure their rightful investments.

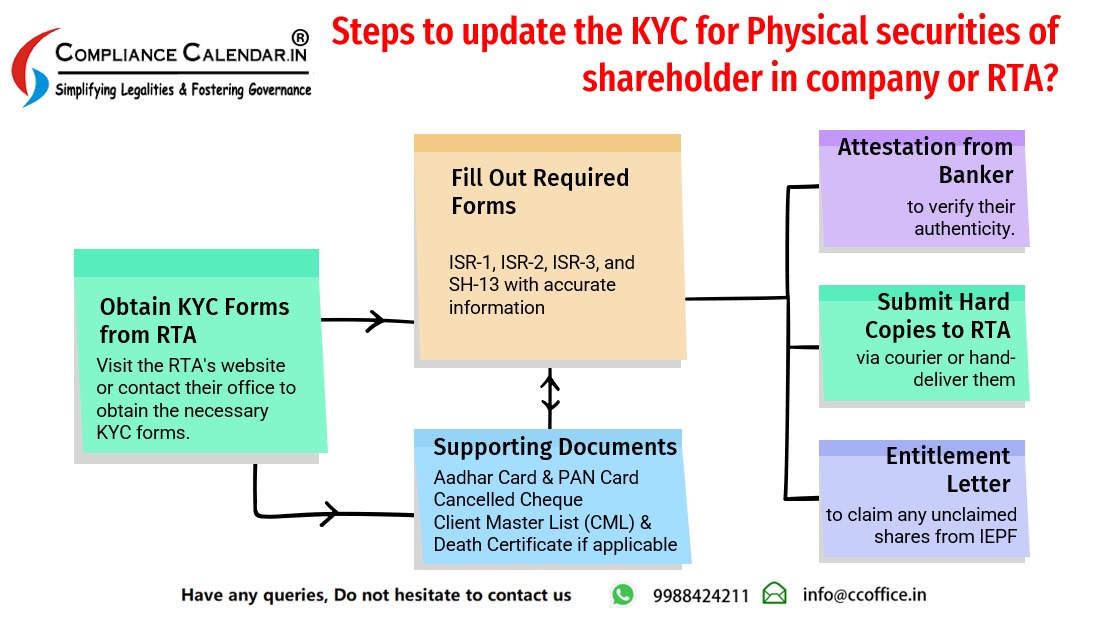

Steps by step process for KYC Updation:

1. Obtain KYC Forms:

Shareholders need to obtain KYC forms from the RTA (Registrar and Transfer Agent).

2. Fill Out Forms and Attach Documents:

-

Complete forms such as ISR-1, ISR-2, ISR-3, and SH-13.

-

Attach supporting documents including Aadhaar Card, PAN Card, Cancelled Cheque, and Client Master List (CML) of the demat account.

-

In cases of deceased shareholders, include the death certificate for verification.

3. Attestation and Submission:

-

Get the KYC forms attested by a banker.

-

Submit the completed forms and supporting documents in hard copy to the RTA.

4. Follow-up and Confirmation:

-

Engage in effective communication with the RTA, the company handling the shares, and relevant authorities.

-

Clarify any queries and follow up on the status of your KYC updation process.

-

Follow up with the RTA to ensure timely processing.

-

Obtain confirmation and the Entitlement letter from the RTA, which is necessary for claiming unclaimed shares from the IEPF.

5. Obtain Entitlement Letter from RTA:

-

Upon successful verification and completion of KYC updation, request an Entitlement letter from the RTA.

-

The Entitlement letter is crucial as it confirms your eligibility to claim the unclaimed shares from IEPF.

Required Documents for KYC updation

-

Aadhaar Card: Provide a copy of your Aadhaar card for identification purposes.

-

PAN Card: Submit a copy of your PAN card for tax-related verification.

-

Cancelled Cheque: Attach a canceled cheque to verify your bank account details.

-

Client Master List (CML) of Demat Account: Include a copy of the CML to validate your Demat account.

-

Death Certificate (if applicable): In case of the shareholder's demise, provide the death certificate for verification.

Why is KYC Updation Mandatory?

-

Fraud Prevention: Verifying ownership through KYC prevents fraudulent claims and ensures that only legitimate shareholders can claim their entitlements.

-

Communication and Benefits: Updated KYC details facilitate effective communication with RTAs and companies, enabling shareholders to exercise their rights such as receiving dividends, participating in corporate actions, and exercising voting rights.

KYC Updation to Recover Unclaimed Shares from IEPF:

KYC updation is a mandatory process by SEBI to verify and update shareholder details, ensuring accurate ownership records and preventing fraudulent claims, the process is a pre-requirement for shareholders dealing with physical securities and is facilitated through specific forms and documentation.

Timeline for KYC Updation: The KYC updation process typically takes between 30 to 45 days to complete, depending on the responsiveness of the RTA and the completeness of the submitted documentation.

Frequently Asked Questions

-

What is the Role of Compliance Calendar LLP?

Compliance Calendar LLP offers comprehensive support throughout the recovery process including assisting with application submission, liaising with the Registrar and Transfer Agent (RTA) and other authorities, and managing legal procedures such as shares transmission and issuance of duplicate shares.

-

What is the Importance of IEPF?

The Investor Education and Protection Fund (IEPF) ensures that unclaimed dividends and shares are managed efficiently. Shares that remain unclaimed for more than 7 years are transferred to the IEPF, where they are safeguarded until claimed by rightful owners.

-

Why Recover Shares from IEPF?

Recovering shares from the IEPF is important for shareholders who may have forgotten to claim their investments or for heirs of deceased shareholders, ensuring that rightful owners receive their due dividends and maintain ownership rights in the company.

Disclaimer:

Recovering unclaimed shares from the IEPF and ensuring KYC updating are important processes for shareholders. These steps not only protect investor interests but also uphold transparency and compliance within the securities market. By adhering to SEBI guidelines and collaborating with trusted service providers like Compliance Calendar LLP, shareholders can navigate these processes smoothly, reclaim their rightful investments, and maintain their ownership rights effectively.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)