What is Form IEPF-5 and how to file it?

Form IEPF-5 is an Application form to the authority for claiming unpaid amounts and shares from the Investor Education and Protection Fund (IEPF) and must be filed following subsection (3) of Section 125 of the Companies Act, 2013, and Rule 7(1) of the Investor Education and Protection Fund Authority (Accounting, Audit, Transfer, and Refund) Rules, 2016. Form IEPF-5 was introduced under the Companies Act, 2013 and No fee is required for filing Form IEPF-5, but Additional fees are applicable for delays in filing the e-Verification Report as per the following table: If the filing of Form IEPF-5 is delayed by up to 30 days, an additional fee of Rs. 50 per day is payable, with a maximum cap of Rs. 2500.

Applicable Provisions

Section 125(3): The Investor Education and Protection Fund (IEPF) shall be utilized for the following purposes: (a) Refund of unclaimed dividends, matured deposits, matured debentures, application money due for refund, and interest thereon; (b) Promotion of investors’ education, awareness, and protection; (c) Distribution of disgorged amounts to eligible and identifiable applicants who suffered losses due to wrongful actions, as per court orders for disgorgement; (d) Reimbursement of legal expenses incurred in pursuing class action suits under sections 37 and 245, sanctioned by the Tribunal, by members, debenture-holders, or depositors; (e) Any other purpose incidental thereto, as prescribed by rules.

Rule 7(1): Upon submission, Form IEPF-5 shall be transmitted online to the company's Nodal Officer for claim verification: Provided that the claimant, after applying in Form IEPF-5, must send the original physical share certificate, bond, deposit certificate, debenture certificate, etc., along with an Indemnity Bond, Advance Receipts, and other documents listed in Form IEPF-5, duly signed, to the Nodal Officer at the company's registered office for claim verification.

The Investor Education and Protection Fund Authority

It was established under section 125 of the Companies Act, 2013 by the Government of India (“GOI”) on September 7, 2016, and plays an important role in protecting investor interests and promoting financial awareness in the Capital market. Its main functions include administering the Investor Education Protection Fund (IEPF) and facilitating refunds or recovery for unclaimed shares, dividends, matured deposits, debentures, and other related funds to investors. Moreover, it focuses on educating investors, distributing disgorged amounts as ordered by courts, reimbursing legal expenses for class action suits, and addressing other incidental purposes outlined in the relevant rules to promote investor awareness and protect their interests.

As per the provisions of this amendment, any amounts that remain unpaid and unclaimed for a period of “seven (7) years” from their due dates are transferred to the Fund, including:

-

Unpaid dividends held in company accounts.

-

Application money received by companies for securities allotment that remains due for refund.

-

Matured deposits and debentures with companies.

-

Accrued interest on the amounts mentioned above.

-

Grants and donations contributed to the Fund by the Central Government, State Governments, companies, or other institutions for its purposes.

-

Interest or other income earned from investments made by the Fund.

Utilization of the Fund (IEPF)

The Fund is used for:

- Refunding unclaimed dividends, matured deposits, debentures, and application money along with accrued interest.

- Promoting investors' education, awareness, and protection.

- Distributing disgorged amounts as per court orders.

- Reimbursing legal expenses for class action suits.

- Other purposes incidental to the Fund's objectives as prescribed.

Claims and Refunds

Every individual entitled to amounts transferred to the IEPF Fund can claim refunds according to the rules specified under the Act. The IEPF serves to safeguard investors' interests by managing unclaimed funds, promoting financial literacy, and ensuring transparency in its operations through rigorous auditing and reporting mechanisms.

Through this article, we will take you through the detailed provisions regarding the Investor Education and Protection Fund (IEPF) as per the Ministry of Corporate Affairs (MCA) guidelines:

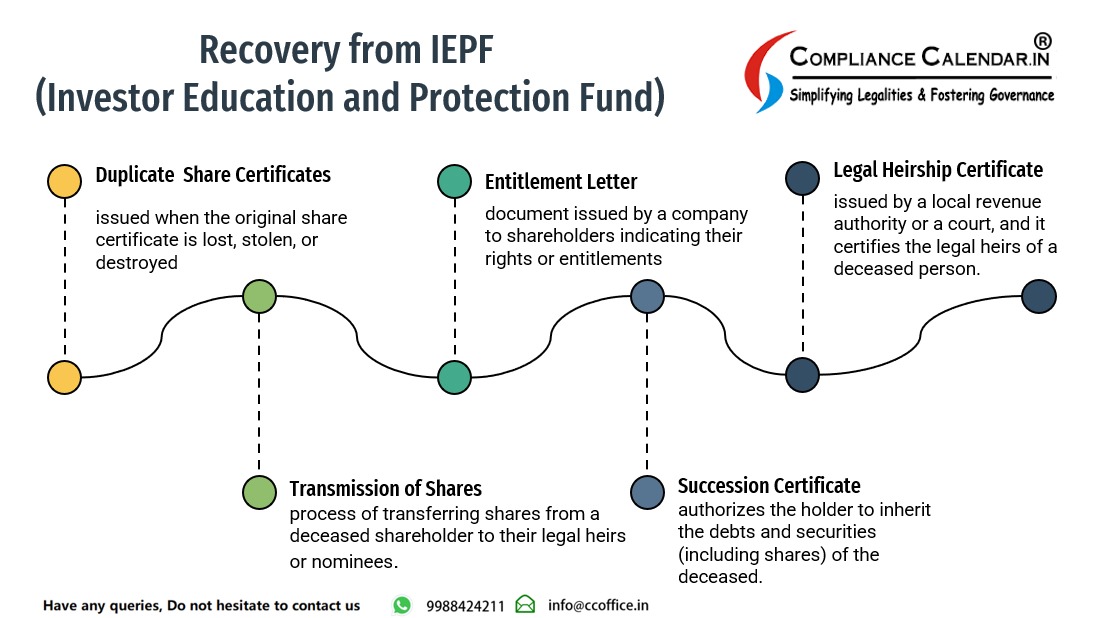

1. Recovery of Shares:

-

Lost or Misplaced Shares: Shareholders may apply to the company for the issue of duplicate share certificates if the original share certificates are lost, stolen, or destroyed.

-

Unclaimed Shares/IEPF Shares: When the shareholders did not encash the dividends due to change of address, Bank details, or Death of Shareholders.

-

Procedure: Typically involves submitting an indemnity bond, affidavit, and other necessary documents as prescribed by the company.

-

Regulatory Framework: Governed by company law provisions and regulations set forth by the MCA.

2. Transmission of Shares After Death of an Original Shareholder:

-

Legal Heirs: Shares of a deceased shareholder are transferred to legal heirs or beneficiaries.

-

Procedure: Requires submission of death certificate, Legal heir Certificate, succession certificate, Court Orders, Probate of will, or other legal documents as per company rules.

-

Compliance: Companies ensure compliance with inheritance laws and procedures outlined under the Companies Act.

3. Transfer of Physical Shares:

-

Process: Shareholders must initiate the transfer by submitting share transfer forms along with physical share certificates to the company's Registrar and Transfer Agent (RTA).

-

Documentation: Includes share transfer deeds, relevant certificates, and other supporting documents.

-

Verification: RTA verifies documents and processes the transfer as per regulatory requirements.

-

Stopped Transfer of shares: Transfer of shares in physical form in respect to Recovery of Shares done away with effect from April 1, 2019. The shareholders who continue to hold shares and other types of securities of listed companies in physical form even after this date, will not be able to lodge the shares with the company / its RTA for further transfer. For further information please click here on SEBI announcement.

What is the Difference between Transmission of Shares and Transfer of Shares?

-

Meaning: While the transfer of shares relates to a voluntary act of the shareholder, transmission is brought about by operation of law. The word 'transmission' means devolution of title to shares other than by transfer, for example, devolution by death, succession, inheritance, bankruptcy, marriage, etc.

-

Procedure: In case of Transmission of Shares the person in whose name the shares are transmitted must give proof that he is a legal representative of the concerned person and in case of Transfer an application is made to the company to transfer which is signed by the Transferor and Transferee. The directors decide whether to approve the transfer or not.

4. Issue of Duplicate Share Certificates:

-

Procedure: Shareholders submit an application to the company along with an ISR-4 form, FIR, Advertisement, Indemnity bond, and affidavit detailing the loss certificates. After submitting the application and forms RTA will issue the LOC (“Letter of confirmation”).

-

Regulations: Companies follow MCA guidelines and regulations for issuing duplicate share certificates to ensure proper safeguards against fraud and misuse.

5. Claiming of Unclaimed Shares from IEPF:

-

Transfer of Unclaimed Shares to IEPF: A company must transfer the shares where the dividend has not been claimed or paid for more than seven years to the IEPF along with interest accrued.

-

Claim Procedure: Shareholders can claim their shares from the IEPF by applying the prescribed IEPF-5 form along with supporting documents at MCA

-

Verification and Approval: IEPF verifies the claim and processes the refund to the rightful owner as per the Companies Act provisions.

6. Claim of Dividend from IEPF:

-

Transfer of Unclaimed Dividend: Unclaimed dividends are transferred to the IEPF if not claimed within the stipulated time.

-

Claim Process: Shareholders can claim their unclaimed dividends from the IEPF by applying in the prescribed format along with the necessary documents.

-

Refund: IEPF verifies the claim and refunds the dividend to the claimant following the rules and regulations.

-

Communication: Shareholders communicate with the RTA for conversion of physical shares into demat, verification of documents, and status updates.

-

Documentation: RTA guides required documentation and procedures for conversion of shares.

-

Compliance: Ensures compliance with MCA regulations and company policies governing share transfers and related activities.

All the above-cited processes are important for shareholders to safeguard their investments, ensure compliance with regulatory requirements, and facilitate efficient management and transfer of shares under the oversight of the Ministry of Corporate Affairs in India.

KYC Documents Requirements under IEPF

-

For Indian Citizens, a self-certified copy of both a PAN Card and an Aadhaar Card must be submitted to prove the claimant's identity.

-

For NRIs, the claimant should submit a self-attested copy of their Passport or Overseas Citizen of India (OCI) card issued by the Ministry of Home Affairs (MHA), along with any other available documents.

-

For foreigners, instead of an Aadhaar Card, a copy of their Passport or Person of Indian Origin (PIO) Card, duly apostatized as per the Hague Convention, is required.

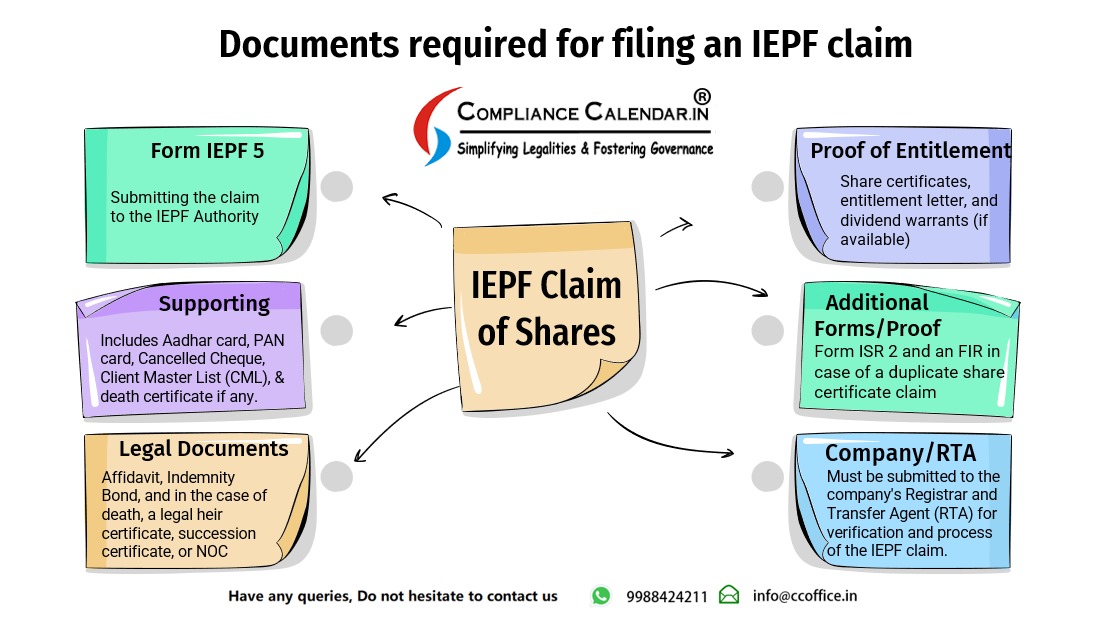

Documents Required for Form IEPF-5 Application:

Documents Required for Form IEPF-5 Application:

-

Aadhaar Card of the claimant and, if applicable, copies for all joint holders - Mandatory

-

Passport, OCI, and PIO card for foreigners and NRIs - Mandatory

-

Client Master List of Demat Account of the claimant - Mandatory

-

Proof of entitlement (e.g., Bonds, Debentures, Fixed Deposit receipts, Share Certificate, Interest warrant, Dividend warrant, Application No., Statement of transaction) - Mandatory

-

Optional Attachments (if applicable):

-

Notarized copy of the death certificate

-

Notarized succession certificate, Probate, or Will

-

No Objection Certificate from another holder (s)

-

Indemnity Bond for Transmission, duly notarized

-

Affidavit in the form of surety

Therefore, the Recovery of shares under the Companies Act, 2013 involves specific legal procedures and adherence to regulatory requirements. Whether it’s reclaiming lost shares, transferring shares after a shareholder’s death, or retrieving unclaimed shares from the IEPF, understanding these processes ensures that shareholders can protect their investments effectively. By following all legal steps and leveraging the provisions laid out by the IEPF, investors can secure their rightful ownership in the corporate world.

This broader approach not only safeguards shareholder rights but also reinforces trust and transparency in India’s corporate governance framework. For more detailed information or assistance on recovering shares, shareholders are encouraged to consult with Compliance Calendar experts or reach out to regulatory authorities like the IEPF Authority for recovery of unclaimed shares.

Disclaimer

The information provided in this article about IEPF (Investor Education and Protection Fund) is intended for general informational purposes only. It is not intended as legal, financial, or investment advice. You should seek advice tailored to your specific circumstances before making any decisions based on the information provided.

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)