A Goods and Services Tax (GST) Registration Certificate is an official document that confirms a business's registration under India's GST system. This certificate is essential for businesses to legally collect GST from customers and claim input tax credits on purchases. Once registered, it's important to download and prominently display this certificate at your place of business. In this article, we will discuss the step-by-step process to download the GST Registration Certificate online.

What is a GST Registration Certificate?

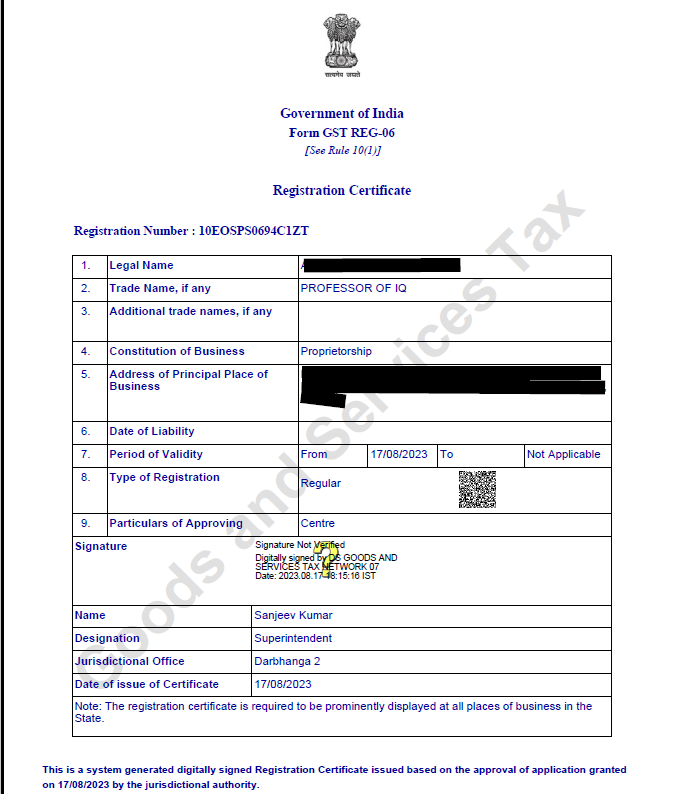

A GST Registration Certificate is an official document issued by the government to businesses and individuals who have successfully registered under the Goods and Services Tax (GST) regime in India. This certificate is provided in Form GST REG-06 and contains essential details such as the GST Identification Number (GSTIN), the principal place of business, and any additional business locations registered under the GST framework.

The GST registration certificate is only available for download on the GST portal, and the government does not issue a physical copy of the certificate. Every registered taxpayer must keep a digital copy of the certificate and display it at their business premises.

Check the sample of a GST Registration Certificate:

Who Needs a GST Registration Certificate?

The GST Registration Certificate is issued to various categories of taxpayers, including:

1. Regular Taxpayers - Businesses and individuals who are required to register for GST based on turnover or business operations.

2. TDS and TCS Applicants - Those registered under Tax Deducted at Source (TDS) and Tax Collected at Source (TCS) provisions of GST.

3. Unique Identity Number (UIN) Holders - Entities required to obtain a Unique Identity Number (UIN) under Section 25(9) of the CGST Act (such as embassies and international organizations).

4. Non-Resident Taxpayers - Individuals or businesses not based in India but providing taxable supplies in India, including Online Information and Database Access or Retrieval (OIDAR) service providers.

5. Migrated Taxpayers - Those who were already registered under previous tax laws (VAT, Service Tax, Excise, etc.) and were automatically migrated to GST.

Importance of the GST Registration Certificate:

• Legal Compliance: It's mandatory to display the GST certificate at all business locations.

• Facilitates Business Operations: Necessary for various business activities, including opening a bank account in the business name and processing large transactions.

• Enhances Credibility: Demonstrates that the business is compliant with tax regulations, which can build trust with customers and partners.

Regularly ensure that your GST certificate reflects accurate and up-to-date information about your business. If there are any changes in your business details, such as a change in address or business structure, it's crucial to update this information on the GST portal and download the revised certificate.

Process to Download GST Registration Certificate Online

The following is the online process to download GST Registration Certificate:

Step 1: Visit the GST Portal

• Go to the official GST Portal: www.gst.gov.in

Step 2: Login to Your Account

• Click on "Login" at the top right corner.

• Enter your Username, Password, and Captcha Code.

• Click on "Login".

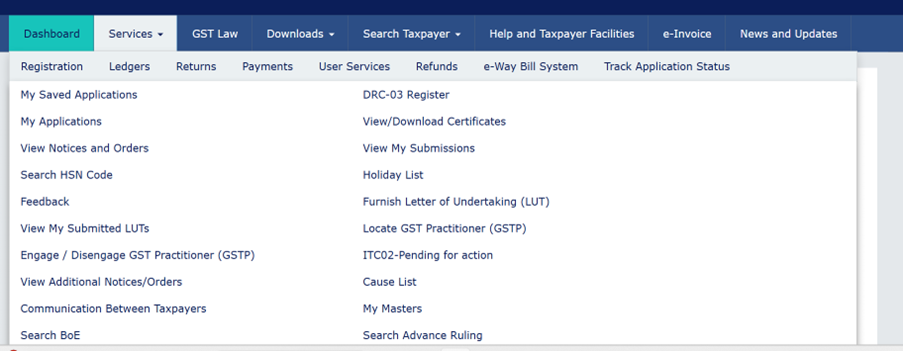

Step 3: Navigate to 'View/Download GST Certificate'

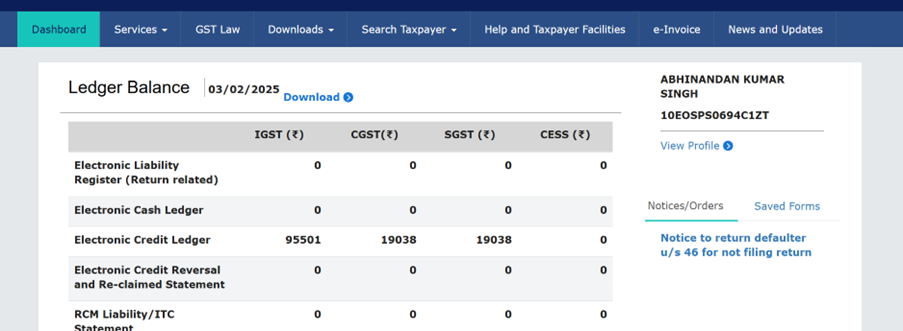

• After logging in, go to the ‘Services’ tab in the main menu.

• Select ‘User Services’ → Click on ‘View/Download Certificates’.

Step 4: Download the GST Registration Certificate

• You will see a list of available certificates.

• Click on ‘Download’ next to the GST Registration Certificate (GST REG-06).

• The certificate will be downloaded in PDF format.

Step 5: Open and Print the Certificate

• Open the downloaded GST Registration Certificate.

• Print and display it at your place of business, as required under GST law.

Details Included in GST Registration Certificate (GST REG-06)

The GST certificate contains:

1. GSTIN (GST Identification Number).

2. Legal Name and Trade Name of the Business.

3. Business Type (Regular, Composition, Casual, etc.).

4. Principal and Additional Place(s) of Business.

5. Registration Date and Validity.

6. Types of Business Activities (Manufacturing, Trading, Services, etc.).

7. QR Code for verification.

Validity Period of the GST Registration Certificate

The validity of a GST Registration Certificate depends on the type of taxpayer:

1. Regular Taxpayers

For regular businesses, the GST registration certificate does not expire as long as the registration is active, valid, and not cancelled or surrendered. The taxpayer can continue using the same certificate indefinitely.

2. Casual Taxable Persons

For a casual taxable person (a business that operates temporarily in a state or union territory), the GST certificate is valid for a maximum of 90 days. If the business needs to extend its operations, the taxpayer must apply for an extension before the expiry date.

3. Delayed Processing Cases

If there is a delay in processing the GST registration application by the tax officer under CGST Rule 9(5), the officer must issue the signed registration certificate within three working days after the processing deadline.

4. Late GST Registration

• If the taxpayer applies for GST registration within 30 days of becoming liable for GST, the certificate is valid from the date of liability.

• If the registration application is submitted late, the validity begins only from the date the certificate is granted, as per CGST Rules 9(1), 9(3), and 9(5).

Important Points to Remember

1. The GST certificate is issued digitally—there is no physical copy provided by the government.

2. Ensure that your business details are correct—any errors should be rectified through an amendment request.

3. The GST certificate must be displayed at your business premises as per GST rules.

4. Download a fresh copy whenever updates or changes are made to your registration.

Conclusion

A GST Registration Certificate is a mandatory document for businesses registered under Goods and Services Tax (GST) in India. It is issued only in digital format via the GST portal and must be displayed at the business premises. The certificate remains valid indefinitely for regular taxpayers but has a 90-day validity for casual taxable persons.

Taxpayers should ensure their details are updated on the GST portal and download a fresh certificate whenever any amendments are made. By following proper GST compliance, businesses can avoid penalties and continue smooth business operations.

FAQs

Q1. What is a GST Registration Certificate?

Ans. A GST Registration Certificate is an official document issued by the government to businesses registered under the Goods and Services Tax (GST) regime in India. It serves as legal proof of GST registration and includes details like GSTIN, business name, address, and registration type. The certificate is available in Form GST REG-06 and can only be downloaded from the GST portal.

Q2. Is the GST Registration Certificate issued in a physical format?

Ans. No, the GST Registration Certificate is not issued in physical form. It is only available in digital format on the GST portal. Taxpayers need to download and print it for display at their place of business.

Q3. Is it mandatory to display the GST Registration Certificate at my business premises?

Ans. Yes, according to CGST Rule 18(1), every registered taxpayer must display the GST Registration Certificate at their principal place of business and all additional places of business listed in Form GST REG-06. Failure to do so can result in a penalty of up to Rs. 25,000.

Q4. What details are included in the GST Registration Certificate?

Ans. The GST Registration Certificate contains the following details:

• GSTIN (Goods and Services Tax Identification Number)

• Legal name and trade name of the business

• Principal and additional places of business

• Type of registration (Regular, Composition, Non-resident, etc.)

• Date of registration and liability start date

• QR code for verification

Q5. Does the GST Registration Certificate have an expiry date?

Ans. • For regular taxpayers, the GST Registration Certificate does not expire as long as the registration is active.

• For casual taxable persons, the certificate is valid for 90 days but can be renewed if required.

• If GST registration is cancelled, the certificate becomes invalid.

Q6. How can I update my GST Registration Certificate?

Ans. If there is any change in business details such as address, trade name, or business structure, you can update your GST registration by:

1. Logging into the GST portal.

2. Going to 'Services' > 'Registration' > 'Amendment of Registration'.

3. Updating the necessary details and submitting the request.

4. Once approved, you can download the updated GST Registration Certificate from the GST portal.

Q7. What should I do if my GST Registration Certificate is lost or misplaced?

Ans. Since the GST Registration Certificate is only issued in digital format, you can log in to the GST portal anytime and download it again. If you have lost the printed copy, simply reprint the downloaded certificate and display it at your business premises.

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)