All Foreign Subsidiary Registration in India, including wholly owned subsidiaries (WOS), must file FC-GPR for FDI related to investment in securities. In addition to this, they must also file the FLA (Foreign Liabilities and Assets) return to report their foreign liabilities and assets, compliance is mandated by RBI's FEMA guidelines and helps maintain accurate records of foreign investments.

The Annual Return on Foreign Liabilities and Assets (FLA) is a mandatory annual filing requirement for Indian companies, Limited Liability Partnerships (LLPs), and other entities that have either received Foreign Direct Investment (FDI) or made FDI abroad, the requirement is stipulated Annual Return on Foreign Liabilities and Assets (FLA) under FEMA 1999 and is specifically outlined in A.P. (DIR Series) Circular No. 45 dated March 15, 2011.

Entities that have received FDI or have made outbound FDI investments must report their foreign liabilities and assets as of the end of the financial year (March 31) and reporting helps the Reserve Bank of India (RBI) and other financial authorities to accurately compile India's Balance of Payments (BoP) and International Investment Position (IIP).

The FLA return provides detailed information on the entity's financial dealings with foreign entities, including the amount and type of investments received or made, ensuring that the data reflects the true financial position concerning foreign investments.

Compliance with the FLA return filing ensures transparency and accuracy in reporting foreign investments, contributing to the effective monitoring and management of India's economic activities at an international level.

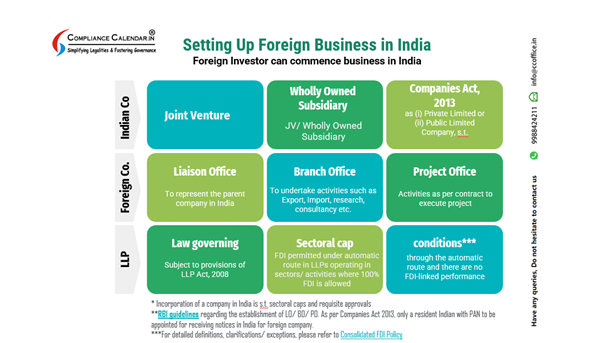

You should also learn about Wholly Owned Subsidiary (WOS) Company and how is it different from a Subsidiary Company. Click here for more.

What is the FLA return?

The "Foreign Liabilities and Assets" (FLA) return is an annual compliance requirement for all entities that have either foreign assets or foreign liabilities, or both, in their Balance Sheet, including those who have made a Foreign Direct Investment (FDI) or Overseas Direct Investment (ODI), whether in any previous year (P.Y.) or the current year (C.Y.).

The FLA return is required for the Reserve Bank of India (RBI) to participate in the Co-ordinated Direct Investment Survey (CDIS) and Co-ordinated Portfolio Investment Survey (CPIS) conducted by the International Monetary Fund (IMF), consolidates information on foreign financial liabilities and assets as of the end of March of the previous and latest financial years, aiding in the compilation of India's Balance of Payments (BoP) and International Investment Position (IIP), and key points are:

-

Mandatory Filing: The FLA must be filed if there are outstanding FDI or ODI, regardless of whether there were any FDI or ODI transactions in the reporting year.

-

No Outstanding Investment: If there is no outstanding investment regarding ODI and FDI as of March-end, then there is no need to file the FLA return. Example: If non-resident shareholders transfer their shares to residents and no FDI/ODI is outstanding as of March-end, no FLA return is required.

-

Non-repatriable Basis: Investments on a non-repatriable basis are not considered foreign investments, and hence, the FLA return does not need to be filed in such cases.

Due Date for Filing FLA Return

The due date for filing the Foreign Liabilities and Assets (FLA) return is 15th July of every year. However, if you do not have audited financials available before this due date, the FLA return must be submitted based on unaudited or provisional accounts.

Once the accounts are audited, a revised FLA return should be submitted by 30th September of the same year.

-

Initial Submission: By 15th July, based on unaudited or provisional accounts if audited accounts are not available.

-

Revised Submission: By 30th September, once the accounts are audited.

FLA Filing Process & Registration at FLAIR

Step-1: Registration on the RBI Portal FLAIR

-

Access the Portal: Visit the RBI FLAIR Portal at https://flair.rbi.org.in.

-

Create an Account: First-time users need to create an account by submitting the "FLA User Registration Form."

-

Upload Documents: During registration, upload a scanned and signed Authority Letter and a Verification Letter in PDF format.

-

Verification: The RBI will verify the registration details and approve the account.

Step 2: Filing the FLA Return process

-

Login: After successful registration, log in to the portal using your username, password, and a One-Time Password (OTP) sent to your registered email address.

-

Start Filing: Click on "FLA Online Form" and then "Start Filing FLA Form" to begin the filing process.

-

Complete the Form: Enter the required details in the FLA Return form.

-

Submit: Review the information entered and submit the form.

Highlights:

-

Registration: Necessary for first-time users to access the FLAIR portal.

-

Required Documents: The Authority Letter and Verification Letter must be scanned, signed, and uploaded in PDF format during registration.

-

Login Credentials: Use the username, password, and OTP for secure login.

-

Filing Process: Ensure all required details are accurately entered in the FLA Return form before submission.

Sections of the FLA Form

The FLA Form comprises five sections that need to be completed for a comprehensive submission:

Section I - Identification Particulars: Details to Furnish like:

-

Name of the entity

-

PAN (Permanent Account Number)

-

CIN (Corporate Identification Number)

-

Contact person

-

Email ID

-

Mobile number

-

Nature of business

-

Whether the company is listed or not

Section II - Financial Details: Financial details of the entity for the financial year for which the FLA return is being filed.

Section III - Foreign Liabilities: Foreign liabilities outstanding as of the financial year-end, which typically include:

-

Foreign direct investments

-

Portfolio investments

Section IV - Foreign Assets: Foreign assets held as of the financial year-end, including Overseas investments made outside India (ODI)

Section V - Variation Report: This section is auto-filled as it reconciles the data from the previous four sections, ensuring consistency and accuracy.

Additional Considerations for Filing the FLA Return:

-

No FDI/ODI Received in Latest FY: Even if no Foreign Direct Investment (FDI) or Overseas Direct Investment (ODI) was received or made in the latest financial year, the FLA return is still required if there are outstanding investments.

-

Share Application Money Only: Entities with only shared application money and no outstanding FDI/ODI do not need to submit the FLA return.

-

Different Reporting Periods: Only data as of the end of March should be reported in the FLA return.

-

Non-Resident Share Transfer: If non-resident shareholders transfer their shares to residents and no FDI/ODI is outstanding as of March-end, the FLA return is not required.

Key Considerations While Uploading the FLA Return:

When preparing and uploading the Foreign Liabilities and Assets (FLA) Return, it is essential to adhere to the following considerations to ensure accurate and compliant reporting:

1. Inclusion of Expenses in Purchase:

-

All expenses should be included in the purchase category, excluding depreciation.

-

This includes the total amount of capital goods purchased.

2. New CIN Allocation:

-

If a new Corporate Identification Number (CIN) is allotted due to the shifting of the registered office or conversion of the company (e.g., from OPC to Private Limited), the company must re-register on the FLAIR Portal with the new CIN.

-

Previously filed FLA returns will not link with the new CIN.

-

In case of a CIN change, the company must raise a deactivation request.

3. Selection of NIC Code:

-

When an entity engages in multiple activities throughout the year, it must select the Nature of the Industry Code (NIC) from which it has earned the majority of its revenue.

-

Different FLA returns may have different NIC codes depending on the revenue-generating activity.

4. Registration Number for Alternative Investment Funds: Alternative Investment Funds should use the Registration Number provided by SEBI as the Unique Identification Number (UIN) for registration on the FLAIR Portal.

5. Acknowledgement Receipt: The acknowledgment receipt is the sole proof of a filed FLA return.

6. Deactivation Requests:

-

Entities must raise a deactivation request when there is a change in the details of the authorized person, CIN/UIN/LLPIN, or the name and address of the entity.

-

This request can be made to surveyfla@rbi.org.in.

7. Reporting of Domestic Assets and Liabilities: No domestic assets or liabilities should be reported in the FLA return, even if the values are in foreign currency.

8. Overseas Direct Investment (ODI): Section IV on foreign assets captures the financial details of overseas companies where the reporting entity’s equity holding is 10 percent or more.

9. Share Application Money: Share application money received from a foreign investor, even if the shareholder does not hold equity shares of the Indian company, must be reported under the head "other investment" in receivables and payable accounts.

10. Date of First Receipt of FDI: The date of first receipt of FDI should be the settlement date or allotment date.

11. Filing Revised FLA: To file a revised FLA, select the year from the “MULTIPLE YEAR CIN ENABLE SCREEN” and make a request for filing the FLA Form for that particular year.

Non-Submission of FLA Return

-

For filing FLA, due is July 15 each year and if audited financial statements are not available by this date, submit the return using unaudited or provisional accounts. Once the audited accounts are finalized, a revised FLA return must be submitted by September 30 of the same year.

-

Failure to file the FLA return by the due date can result in penalties under FEMA. In case of late filing, companies may also incur Late Submission Fees (LSF).

LSF for Reporting Delays in FLA Submission

- Effective from November 07, 2017, for Foreign Investment (FI), January 16, 2019, for External Commercial Borrowings (ECBs), and August 22, 2022, for Overseas Investment, the LSF ensures uniformity across functions for reporting delays. The LSF calculation matrix is as follows:

1.Periodic Reports without Flow Data:

-

Forms: ODI Part-II/APR, FCGPR (B), FLA Returns, Form OPI, evidence of investment, etc.

-

LSF: INR 7500

-

LSF payment must be made within 30 days of advice issuance, or it becomes void.

-

LSF option available for up to three years from the reporting due date or under FEMA 120/2004-RB regulations for three years from the 2022 regulation notification date.

-

Non-compliance without LSF leads to penal action under FEMA, 1999.

Frequently Asked Questions

Q1. What is the FLA return?

A: The Foreign Liabilities and Assets (FLA) return is a report required by the Reserve Bank of India (RBI) to track the foreign investment and financial interests of Indian companies.

Q2. What is the due date for filing the FLA return?

A: The FLA return is due by July 15 of each year. If audited financial statements are not ready by this date, unaudited or provisional figures can be used. A revised return with audited numbers must be filed by September 30.

Q3. Where can I log in to file the FLA return?

A: The FLA return can be filed on the RBI’s FLA return filing portal. companies need to register and log in to the portal to submit their return.

Q4. What does FLA stand for?

A: FLA stands for Foreign Liabilities and Assets.

Q5. What is the RBI FLA return?

A: The RBI FLA return is a mandatory submission to the Reserve Bank of India that reports foreign investments and holdings by Indian companies.

Q6. What is the FLA return filing portal?

A: The FLA return filing portal is an online platform provided by the RBI where companies can file their FLA returns. The portal requires user registration and login at FLAIR.

Q7. Who needs to file the FLA return?

A: All Indian companies that have received foreign investment or have foreign liabilities are required to file the FLA return, including companies with foreign direct investment (FDI) or external commercial borrowings (ECBs).

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-suratgujarat-section-158_crop10_thumb.jpg)

-suratgujarat_crop10_thumb.jpg)

-(33)_crop10_thumb.jpg)

-ahmedabad_crop10_thumb.jpg)

-learn_crop10_thumb.jpg)

-learnn_crop10_thumb.jpg)

_crop10_thumb.jpg)

_Guidelines_learn_crop10_thumb.jpg)