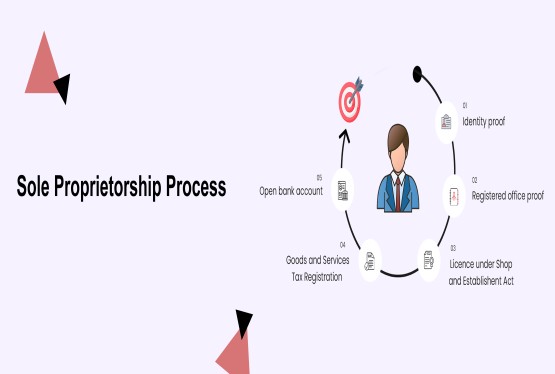

As per Rule 9 of the Companies (Management and Administration) Rules, 2014, a person who is registered as the holder of shares in a company but does not hold the beneficial interest in those shares must file a declaration with the company using Form MGT-4. This declaration must be submitted within thirty days from the date their name is entered in the company’s register of members. Furthermore, if any change occurs in the beneficial interest of those shares, a new declaration must be filed with the company within thirty days.

Similarly, a person who holds the beneficial interest in shares but is not the registered owner of those shares must file a declaration with the company using Form MGT-5 within thirty days of acquiring or upon any change in the beneficial interest.

Upon receiving such declarations, the company is required to:

1. Make a note of the declaration in the register of members.

2. File a return with the Registrar of Companies (ROC) in e-Form MGT-6 within thirty days of receiving the declaration, along with the applicable fee.

Now, In the context of recent amendments introduced via the Companies (Management and Administration) (Second Amendment) Rules, 2023, the Ministry of Corporate Affairs (MCA) has made it mandatory for every company to designate a responsible person for providing information concerning the beneficial interest in the shares of the company and this move is part of the ongoing reforms to enhance transparency and corporate accountability, aligning with Sections 89 and 90 of the Companies Act, 2013.

As per the notification dated 27th October 2023, companies must disclose this designated person’s details in their annual returns (Form MGT-7) and this Compliance Calendar LLP article will elaborate in detail the requirements, implications, and procedures for including such information in the annual return (MGT-7/7A), ensuring full compliance.

About the MCA Notification

The Companies (Management and Administration) (Second Amendment) Rules, 2023 introduces Rule 9(4), which mandates the designation of a specific individual responsible for providing information to the Registrar or other authorized officers regarding the beneficial interest in shares.

-

Applicability to every company, irrespective of whether it has received declarations of beneficial interest.

-

Designation of a Company Secretary (CS), Key Managerial Personnel (KMP), or director as the responsible individual.

-

Mandatory disclosure of this designated person in the company’s annual return.

What is Beneficial Interest in Shares?

Under Section 89 of the Companies Act, 2013, and the related Rule 9 of the Companies (Management and Administration) Rules, 2014, the concept of beneficial interest is clearly defined and regulated.

Beneficial Interest in a share refers to the rights or entitlements of a person, directly or indirectly, through any contract or arrangement, to:

-

Exercise or cause to be exercised any or all of the rights attached to the share, or

-

Receive or participate in any dividend or other distribution concerning the share. This is defined under Section 89(10) of the Companies Act, 2013.

Registered Owner vs. Beneficial Owner:

-

The registered owner is the person whose name is entered in the company’s register of members as the legal holder of the shares.

-

The beneficial owner is the person who enjoys the benefits of the shares (like dividends, voting rights, etc.) even though their name is not entered in the company’s records as the owner of those shares.

As per Section 89 of the Companies Act, any person who holds the beneficial interest in shares that are registered in the name of another person must declare this to the company.

Designation of the Responsible Person ?

The amendment necessitates the formal designation of an individual responsible for disclosing beneficial ownership details. According to Rule 9(4), the designated person should be:

-

A Company Secretary (CS), if the company is required to appoint one under Section 203 of the Companies Act.

-

A Key Managerial Personnel (KMP), if there is no CS or in cases where the company’s size demands a broader compliance structure.

-

Every director of the company if there is no CS or KMP.

Deemed Designation

In the absence of an explicit designation, the following individuals are automatically deemed to be the designated person:

-

Company Secretary (if the company is required to appoint one).

-

Managing Director or Manager (if no CS is appointed).

-

Every Director (if no CS, Managing Director, or Manager is appointed).

This hierarchy ensures that even in cases of non-compliance, there is always an individual accountable for the company’s adherence to the beneficial interest disclosure rules.

Role of the Designated Person ?

The designated person plays a major role in ensuring compliance with the provisions of Sections 89 and individual is responsible for:

-

Furnishing information to the Registrar or other authorized officers.

-

Extending cooperation for any inquiry related to the beneficial interest in the shares of the company.

-

Monitoring the beneficial ownership status of shareholders and ensuring that the company receives timely declarations under Section 89.

This person should be familiar with the legal requirements concerning beneficial ownership and be able to retrieve the necessary information quickly when required by the Registrar of Companies (ROC) or other authorities.

Disclosure of Designated Person Details in Annual Return (Form MGT-7)

As mandated by the amendment, the annual return (Form MGT-7) filed by companies will now need to reflect the details of the designated person, disclosure format will likely be updated to include this section as still MGT-7 not having any option to disclose this for 2024, but based on existing practices, the details that should be included in the annual return may cover the following:

Key Information to Be Disclosed

The annual return must include:

-

Name of the designated person.

-

Designation (whether CS, KMP, or Director).

-

Director Identification Number (DIN), if applicable, or Permanent Account Number (PAN) or Digital Signature Certificate (DSC) details for identification.

-

Date of Appointment as the designated person.

-

Contact Information, such as email address and phone number, in case additional communication is required by regulatory authorities.

Filing Timeline

The annual return is filed after the end of each financial year, typically by the 30th of November for most companies. Since the amendment became applicable on 27th October 2023, this disclosure will be required for FY 2023-24 and beyond.

Reporting of Changes in Designated Person

If there are any changes to the designated person (for instance, a new Company Secretary is appointed, or the existing CS steps down), the company is required to:

-

Update the details in the annual return for that particular year.

-

File Form GNL-2 with the ROC to inform them of any such changes, although no specific timeline is mentioned for this form. However, filing within a reasonable period, ideally within 30 days, is recommended.

Filing Obligations and Penalties for Non-compliance

Failure to designate an individual as the responsible person for beneficial interest or failure to disclose this in the annual return can lead to penalties under the Companies Act, 2013. Companies should ensure that they:

-

Pass a board resolution by the Company to formally designate the person responsible for beneficial interest declarations.

-

Ensure that the person responsible is aware of their duties and maintains vigilance concerning beneficial ownership compliance.

-

File any changes promptly to avoid potential scrutiny from the ROC or other authorities.

Therefore, The inclusion of a designated person for beneficial interest information represents a significant shift towards ensuring transparency in corporate ownership structures. By requiring every company to have a single point of responsibility, the MCA is ensuring that there are no gaps in information when it comes to identifying those who ultimately hold the rights to shares.

This is particularly important in the context of corporate governance and regulatory compliance. Companies must ensure that their designated person is capable of fulfilling the duties outlined by the amendment and that this individual is correctly identified in the company’s annual return (Form MGT-7).

Frequently Asked Questions

Q1. What is the Companies (Management and Administration) Second Amendment Rules, 2023 about?

Ans. The Second Amendment Rules, 2023, require companies to designate a person responsible for providing information about the beneficial interest in shares to the Registrar of Companies or any other authorized officer.

Q2. Does every company need to file Form GNL-2 when changing the designated person?

Ans. Yes, if there are changes to the designated person during the financial year, Form GNL-2 must be filed to notify the ROC of the change.

Q3. Is the designation of a beneficial interest responsible person applicable only to large companies?

Ans. No, the amendment applies to all companies, regardless of size, ensuring uniform compliance across the corporate sector but this provision shall not apply in relation to a trust which is created, to set up a Mutual Fund or Venture Capital Fund or such other fund as may be approved by the Securities and Exchange Board of India

Q4. What information does a designated person need to provide?

Ans. The designated person is responsible for providing information regarding the beneficial ownership of shares to the Registrar or any other authorized officer when required.

Q5. If individuals hold the shares directly in their own names, there is a need to mention beneficial ownership in Form MGT-7 ?

Ans. If individuals hold shares directly in their own names, there is no need to mention beneficial ownership in Form MGT-7, know here why:

-

Direct Ownership: When individuals are both the registered owners and the beneficial owners of the shares, there is no need for a separate declaration of beneficial interest under Section 89 of the Companies Act, 2013. This is because there is no distinction between the person legally registered as the shareholder and the person who actually benefits from the shares.

-

Section 89 – Beneficial Ownership: This section is only triggered when the registered owner (the person whose name is on the company's share register) is different from the beneficial owner (the person who benefits from the shares). If both roles are fulfilled by the same person, there is no need to declare or disclose beneficial interest in Form MGT-7.

-

Form MGT-7 – Annual Return: Form MGT-7 captures the details of registered shareholders, including the number of shares they hold and the percentage of total shareholding. If individual shareholders directly own the shares, only the regular details (such as name, address, and number of shares) need to be included in the form. There is no requirement to mention or declare beneficial ownership separately, as the individual holding the shares is the same person benefitting from them.

If an individual is both the registered owner and the beneficial owner, there is no need to mention any additional details about beneficial ownership in Form MGT-7. The disclosure of beneficial interest is only required when the beneficial owner is different from the registered owner.

Q6. What are the Other Compliances as per Section 89 and Rule 7 of the Companies (Management and Administration) Rules, 2014?

Ans. As per Section 89 and Rule 7 of the Companies (Management and Administration) Rules, 2014, the following compliances must be fulfilled regarding the declaration of beneficial interest:

1. Declaration by Registered Owner (Form MGT-4): If a registered owner holds shares on behalf of someone else (i.e., does not have beneficial interest in the shares), they are required to file a declaration with the company in Form MGT-4. This must be done within 30 days of their name being entered in the company's register of members. This declaration confirms that the registered owner is holding the shares for the beneficial owner.

2. Declaration by Beneficial Owner (Form MGT-5): The beneficial owner (the true beneficiary of the shares) must also file a declaration in Form MGT-5 within 30 days of acquiring the beneficial interest in the shares. This declaration informs the company that, even though the shares are registered in another person's name, the beneficial owner holds the actual rights and benefits related to the shares.

3. Company's Responsibility (Form MGT-6): Once the company receives these declarations (MGT-4 and MGT-5), it must:

-

Record the declarations in the company's register of members.

-

File a return with the Registrar of Companies (ROC) in Form MGT-6 within 30 days of receiving the declarations, providing details of the beneficial ownership.

Q7. What happens if no designated person is appointed?

Ans. Until a designated person is formally appointed, the following individuals will be deemed responsible for providing beneficial interest information:

-

The Company Secretary (if required),

-

The Managing Director or Manager (if there is no Company Secretary), or

-

Every Director (if there is no Company Secretary or Managing Director/Manager).

Q8. What is the effective date of the Second Amendment Rules, 2023?

Ans. The Second Amendment Rules, 2023 came into effect on October 27, 2023, the date of their publication in the Official Gazette.

Q9. What are the actionable items for companies following the amendment?

Ans. Companies must:

-

Designate a responsible person for providing beneficial interest information to the ROC or any authorized officer.

-

Disclose the designated person’s details in the annual return (MGT-7).

-

File e-Form GNL-2 if any changes in the designated person occur.

Q10. When should the designated person’s details be reported in Form MGT-7?

Ans. The details of the designated person must be disclosed in the company’s Annual Return (Form MGT-7) for the very 1st time in the 2024 year ended Annual return.

Q11. Is it applicable in the case of a Wholly Owned Subsidiary (WOS) where one share is held by a nominee shareholder?

Ans. Yes, Section 89 of the Companies Act, 2013, and Rule 9 of the Companies (Management and Administration) Rules, 2014, are applicable in the case of a Wholly Owned Subsidiary (WOS) where one share is held by a nominee shareholder.

In the case of a Wholly Owned Subsidiary (WOS), where typically one share is held by a nominee to comply with the minimum requirement of having more than one shareholder:

-

The nominee is the registered owner of the share, but the parent company is the beneficial owner since the nominee holds the share on behalf of the parent company.

-

These rules under Section 89 and Rule 9 do apply to Wholly Owned Subsidiaries (WOS) where one share is held by a nominee. The nominee and the parent company must comply with the necessary filings (MGT-4 and MGT-5), and the company must fulfill its obligation by filing Form MGT-6 with the Registrar of Companies.

Learn here:What is Wholly Owned Subsidiary (WOS) Company and how it is different from Subsidiary Company?

_crop10_thumb.jpg)

_crop10_thumb.jpg)

-Form_crop10_thumb.jpg)

_crop10_thumb.jpg)

_learn_crop10_thumb.jpeg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_crop10_thumb.jpg)

_for_Foreign_Directors_learn_crop10_thumb.jpeg)

_Act,_2015_learn_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)