Limited Liability Partnership Act, 2008 was enacted to make provisions for the formation and regulation of Limited Liability Partnerships and matters connected therewith or incidental thereto. LLP is an acronym used for Limited Liability Partnership. LLP is an alternative corporate business form that benefits a company’s limited liability and the flexibility of a partnership. LLP form is a form of business model which is organized and operates based on an agreement. LLP Agreement is the main document governing the relationship between the partners and partners and LLP.

Section 13 of the LLP Act, 2008 and Rule 17 of the LLP Rules, 2009 contain the provisions of the Registered Office of the LLP and change therein.

-

Registered Office: Every LLP must maintain a registered office for receiving legal documents, notices, and communications. The office address must be officially recorded with the ROC.

-

Changes in Office: LLPs can change their registered office by following the procedures outlined in their LLP Agreement. If the Agreement is silent on this matter, consent from all partners is required.

How to change the Address of the LLP ?

As per Section 13 of the LLP Act 2008, Every LLP must have a registered office so that all communications and notices may be addressed to it and where they shall be receivable. Documents can be served on an LLP or a partner or designated partner of the LLP which can be sent through a registered post or any other manner at the registered office. A limited liability partnership can shift its registered office by filing the notice of such change with the Registrar in the form 15 and any such change shall take effect only upon such filing.

Procedure for Changing the Registered Office of LLP

There are distinct procedures for shifting an LLP’s registered office within the same state and when shifting to another state. Below is a step-by-step guide for both scenarios:

Change of Registered Office Within the State

When the change is within the same state, either within the jurisdiction of the same Registrar or moving to another jurisdiction within the same state, the procedure is as follows:

| Step | Description |

|---|---|

| Review the LLP Agreement | Ensure that the LLP Agreement addresses the procedure for shifting the office. If it does not, proceed according to Section 13 and Rule 17 of the LLP Rules. |

| Meeting of Partners | Hold a meeting to discuss and approve the office relocation. Notice must be provided to all partners. |

| Pass a Resolution | Obtain unanimous consent or pass a resolution approving the change in the registered office. |

| File Form LLP 15 | After registration as a business user on the MCA portal, file Form LLP 15 with the Registrar of Companies (ROC) within 30 days of passing the resolution. |

| Supplementary LLP Agreement | Execute a supplementary LLP Agreement to reflect the new address, and file it with the ROC in Form LLP 3 within 30 days. |

| Documents Required | Include proof of the new address, a copy of the consent/resolution, and any supplementary LLP Agreement as supporting documents. |

Change of Registered Office to Another State

For changes that involve moving the registered office to another state, additional steps are required:

| Step | Description |

|---|---|

| Review the LLP Agreement | Ensure that the LLP Agreement outlines the procedure for the office change. If not, consent from all partners is required. |

| Meeting of Partners | Hold a partners' meeting to obtain formal consent or pass a resolution to approve the change in the registered office. |

| Consent of Secured Creditors | If the LLP has secured creditors, obtain their No Objection Certificate (NOC) before proceeding with the address change. |

| Publish General Notices | Publish a general notice in a daily English newspaper and a local-language newspaper in the district where the current office is located, at least 21 days before filing Form LLP 15. |

| File Form LLP 15 | After publication of the notices, file Form LLP 15 with the ROC within 30 days, including all necessary attachments. |

| File Supplementary LLP Agreement in Form LLP 3 | File the supplementary LLP Agreement reflecting the new address in Form LLP 3 with the ROC within 30 days of the office change. |

Checklist of Required Documents for Office Shifting

For address change of LLP, the following documents are needed:

| Document | Description |

|---|---|

| Proof of the new registered office address | Utility bill, rent agreement, or any document confirming the new address of the registered office. |

| Consent letter or partners’ resolution | Letter of consent from all partners or a resolution passed during the partners’ meeting approving the office change. |

| No Objection Certificate (NOC) | NOC from the property owner, if the new office is a rented premise. |

| General notices published in newspapers | Copies of general notices published in English and local-language newspapers (required for inter-state changes). |

| Consent letters from secured creditors | Consent letters from secured creditors, if applicable. |

| Original and Supplementary LLP Agreement | The original LLP Agreement along with the supplementary LLP Agreement reflecting the new office address. |

Important Features of an LLP's Registered Office

An LLP (Limited Liability Partnership) is a distinct legal entity, separate from its partners, means that the LLP, as an independent entity, can own property, enter contracts, and face legal action in its own name. The registered office serves as the official address of the LLP where it receives legal notices, communications, and government correspondence and the registered office of LLP must be consistently maintained and properly recorded with the Registrar of Companies (ROC).

Flexibility to Change:

One of the advantages of an LLP structure is the flexibility it provides, including the ability to change the registered office as needed. Such a change can be made either by following the procedures laid down in the LLP Agreement or by adhering to the statutory guidelines provided in the LLP Act, 2008, and the LLP Rules, 2009. The LLP Agreement may specifically outline the steps, but if it doesn’t, the LLP must obtain the consent of all partners and comply with legal procedures.

Inter-State Changes:

When an LLP plans to move its registered office from one state to another, additional legal requirements come into play. The LLP is required to publish a general notice in newspapers (both in English and the local language of the district), informing the public of the planned change. Moreover, if the LLP has any secured creditors, their No Objection Certificate (NOC) must be obtained before proceeding with the move. Lastly, after fulfilling these requirements, the LLP must notify the ROC of both the origin and destination states through the proper filing procedures to ensure that the office change is legally recognized.

Frequently Asked Questions (FAQs)

Q1. What are the penalties for non-compliance with Section 13 of the LLP Act?

Ans. If the LLP fails to comply with the requirements of Section 13, a penalty of Rs 500 per day, up to a maximum of Rs 50,000, may be imposed.

Q2. Is Form LLP 3 required for shifting the registered office?

Ans. Yes, after executing the supplementary LLP Agreement for the change of office, Form LLP 3 must be filed within 30 days.

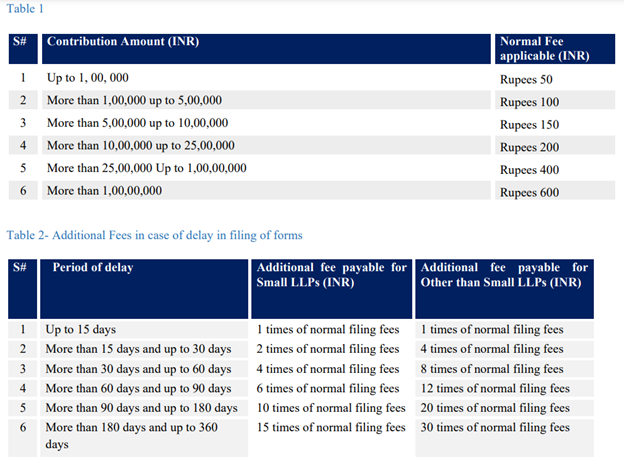

Q3. What are the filing fees for Form LLP 15 and Form LLP 3?

Ans. Filing fees vary depending on the contribution of the LLP. For LLPs with a contribution of up to Rs 1 lakh, the fee is Rs 50, and it increases as the contribution amount rises.

Q4. Do we need to file notices in both states for inter-state changes?

Ans. Yes, Form LLP 15 must be filed with both the ROC of the origin state and the destination state.

Q5.What is the stamp duty for the supplementary agreement?

Ans.The supplementary agreement should be executed on a stamp paper of Rs 500.

Q6. What are the fees for filing LLP Form 15?

| Sr. No | For Application Made | Amount (in Rs) |

|---|---|---|

| (i) | LLP whose contribution does not exceed Rs 1 Lakh | 50 |

| (ii) | LLP whose contribution exceeds Rs 1 Lakh but does not exceed Rs 5 Lakhs | 100 |

| (iii) | LLP whose contribution exceeds Rs 5 Lakhs but does not exceed Rs 10 Lakhs | 150 |

| (iv) | LLP whose contribution exceeds Rs 10 Lakhs but does not exceed Rs 25 Lakhs | 200 |

| (v) | LLP whose contribution exceeds Rs 25 Lakhs but does not exceed Rs 1 Crore | 400 |

| (vi) | LLP whose contribution exceeds Rs 25 Lakhs but does not exceed Rs 1 Crore | 600 |

Q7. What are the fees for filing LLP Form 3?

| Sr. No | For Application Made | Amount (in Rs) |

|---|---|---|

| (i) | LLP whose contribution does not exceed Rs 1 Lakh | 50 |

| (ii) | LLP whose contribution exceeds Rs 1 Lakh but does not exceed Rs 5 Lakhs | 100 |

| (iii) | LLP whose contribution exceeds Rs 5 Lakhs but does not exceed Rs 10 Lakhs | 150 |

| (iv) | LLP whose contribution exceeds Rs 10 Lakhs but does not exceed Rs 25 Lakhs | 200 |

| (v) | LLP whose contribution exceeds Rs 25 Lakhs but does not exceed Rs 1 Crore | 400 |

| (vi) | LLP whose contribution exceeds Rs 25 Lakhs but does not exceed Rs 1 Crore | 600 |

Q8. What is the stamp duty to be paid on the Supplementary Agreement?

Ans.Supplementary Agreement for changing the place of office must be executed on Stamp Paper of Rs 500.

Q9. Whether Form LLP 15 & Form LLP 3 linked forms?

Ans. Form LLP 15 & Form LLP 3 are individual forms that are to be filed separately.

Q10. Is Form 3 required when shifting the Registered Office, and how do I update my LLP agreement?

Ans. Yes, Form 3 must be filed when shifting the registered office of an LLP. The LLP is required to create a supplementary agreement, as the clause regarding the place of office in the initial LLP agreement must be updated. This is done by drafting a supplementary deed on a Rs. 100 stamp paper, which must be properly signed and executed to reflect the new registered office address.

Q11. What are the penal provisions for not complying with the requirements of Section 13 of the LLP Act 2008 i.e. Registered office of LLP & Change therein?

Ans. In case there is any non-compliance with the requirements of Section 13, the LLP & its partner shall be liable to a penalty of Rs 500 for each day during which the default continues subject to the maximum amount of Rs 50,000 for the LLP and its partner.

Q12. Can a LLP have any other address in addition to registered address?

Every Limited Liability Partnership (LLP) must have a principal place of business known as the registered office, the address where official correspondence and legal notices are sent. The registered office can be located anywhere in India. Moreover, an LLP may have other offices such as corporate, administrative, or branch offices, unlike Private Limited companies.Every LLP shall have a registered office so that one can send & address notices & communications. An LLP can shift its registered office anytime due to its own reasons such as for administrative convenience and better control over the operations. For Shifting the registered office, we need to follow the procedure as prescribed in the LLP Agreement or under the LLP Act, 2008 and LLP Rules 2009. We at Compliance Calendar LLP, having a team of experienced professionals, can help you to comply with the procedural aspects, drafting the Supplementary LLP agreement, and filing the required LLP forms with respect to shifting of registered office from one place to another.

Further, an LLP can change its registered office address within the same city, town, or village, or even relocate to a different state. Any amendment to the LLP Agreement reflecting this change must also be filed with the ROC within the same timeframe in Form 3

Q13. What is address proof for LLP?

Ans. A PAN card serves as a primary identification document.For residence proof, partners can submit one of the following: Voter ID, Passport, Driver's License, utility bills (not older than two months), or an Aadhaar card. Acceptable utility bills include telephone, mobile, electricity, or gas bills.

Q14. Is notarization mandatory for an LLP agreement?

Ans. Yes, the LLP Agreement must be printed on non-judicial stamp paper, signed by all partners, and notarized to be legally valid.

Q15. What is the penalty for not filing the LLP agreement?

Ans. Failure to file the LLP agreement can result in a fine as follows:

_crop10_thumb.jpg)

_for_FY_2025-26_crop10_thumb.jpg)

_learn_crop10_thumb.jpg)

_Filing_Due_Dates_for_FY_2024-25_learn_crop10_thumb.jpeg)